Taxpayers should be alarmed at final 2026–27 budget passed by the Texas Legislature.

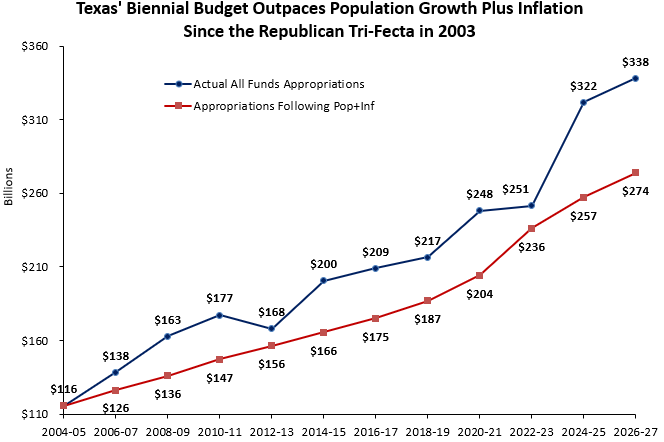

What started as competing proposals from the Senate and House has ended in a bloated conference committee budget that dramatically expands state government beyond what key measures like population growth and inflation would justify.

Despite claims of fiscal conservatism, this final product mirrors the spending habits of progressive states like California more than it does the limited government model that made Texas an economic powerhouse.

Here’s a breakdown of how we got here, and why it matters.

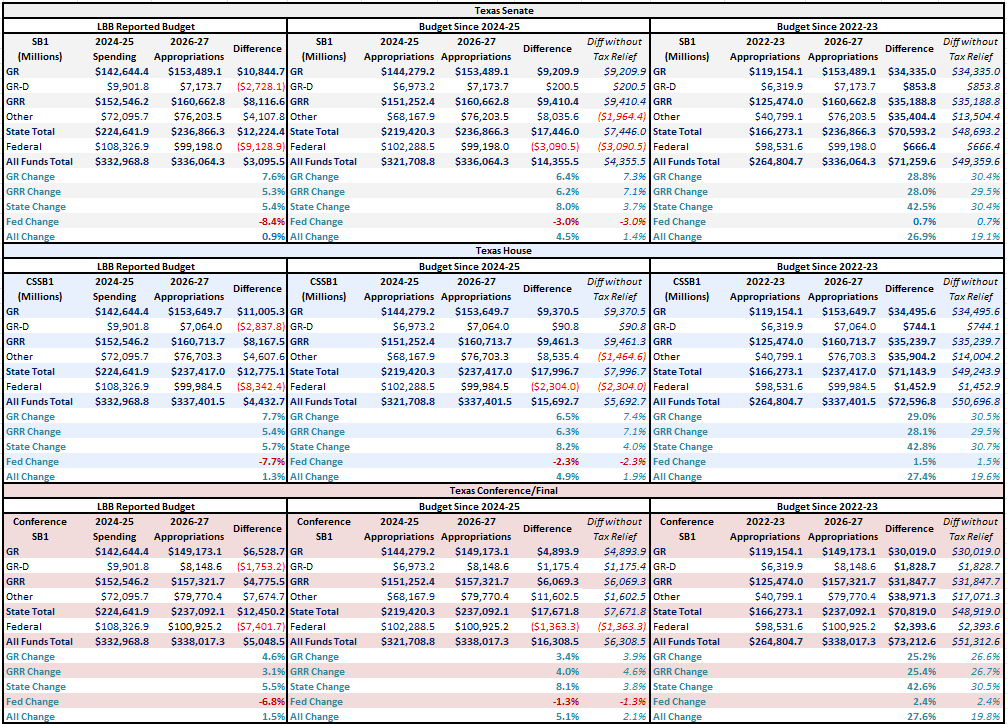

Comparing the Budgets: Senate, House, and Conference

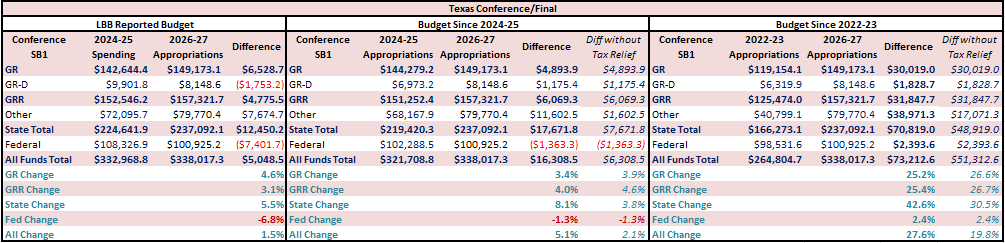

Using a consistent apples-to-apples comparison of appropriations to appropriations, the growth from the 2022–23 budget to the 2026–27 budget is staggering. Since then, the maximum growth rate of population growth plus inflation has been 20%. Yet each version of the new budget far exceeds that:

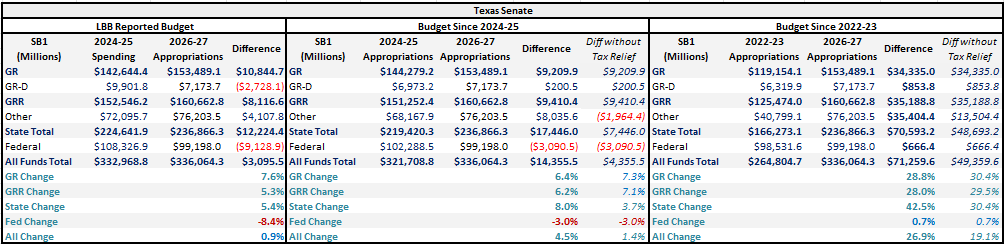

Senate Budget:

- State appropriations increased from $166.3 billion to $236.9 billion — a 42.5%increase.

- All funds appropriations rose from $264.8 billion to $336.1 billion — a 26.9%increase.

- Even excluding tax relief, state appropriations still grew 30.4%.

- GRR funds increased by $35.2 billion, or 28.0%.

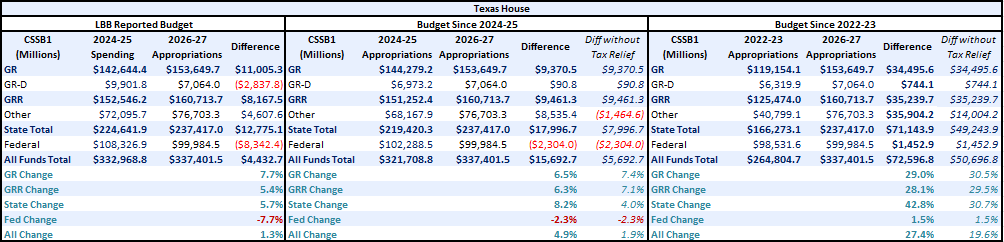

House Budget:

- State appropriations increased from $166.3 billion to $237.4 billion — a 42.8%increase.

- All funds appropriations rose from $264.8 billion to $337.4 billion — a 27.4%increase.

- Excluding tax relief, state appropriations still rose 30.7%.

- GRR funds increased by $35.2 billion, or 28.1%.

Conference (Final) Budget:

- State appropriations increased from $166.3 billion to $237.1 billion — a 42.6%increase.

- All funds appropriations increased from $264.8 billion to $338.0 billion — a 27.6% increase.

- Even excluding tax relief, state appropriations still grew by 30.5%.

- GRR funds increased by $31.8 billion, or 25.4%.

Each budget proposal got bigger, not smaller, throughout the process. Instead of aligning spending with population and inflation growth, lawmakers escalated the budget with every iteration—an unsustainable trend.

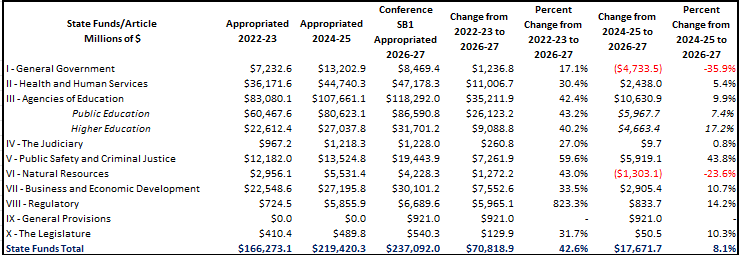

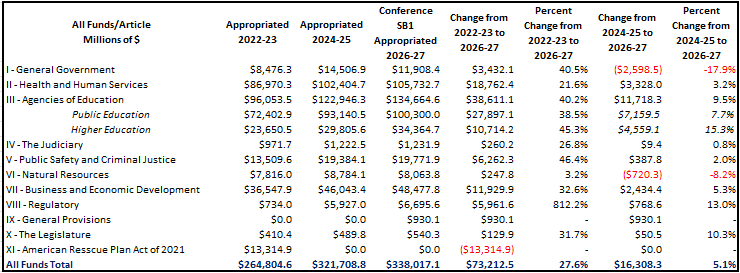

Major Spending Increases by Budget Area

The 2026-27 budget reveals unsustainable growth across nearly every article of government. In state funds, Article II for Health and Human Services is up 30.4% over 2022–23, with an additional 5.4% increase from 2024–25. Article III, covering Education, soared by 42.4%, with public education up 43.2% and higher education up 40.2% since 2022–23. Even areas like Article V for Public Safety grew by nearly 60%.

Looking at all funds, the trends are equally alarming. Article III rose by 40.2%, including a 38.5% increase in public education and a 45.3% increase in higher education. Health and Human Services (Article II) grew by $18.8 billion or 21.6%. Even Regulatory functions (Article VIII) increased by over 800% over the 2022–23 budget.

This is not a conservative budget—it’s a big government expansion.

The False Justification: Temporary Tax Relief

Supporters of the budget may claim that the spike in appropriations is justified because of historic property tax relief. But even after backing out tax relief, the budget increases are well above any reasonable threshold. In short, the relief is temporary, but the spending is permanent. This sleight of hand will lead to even higher property tax burdens in future years if spending is not restrained.

The Legislative Budget Board claims $51 billion in tax relief, which is a misleading total. It includes maintaining past tax cuts and contingent new ones, but does not include any structural restraint to prevent property taxes from rising again. There are no local spending limits or end to loopholes to property tax levy limits, while reducing the rollback rate to the no-new-revenue rate, so property taxes will keep going up. This is not reform—it’s an expensive illusion.

Bigger Than the Numbers: A Progressive Budget in Disguise

This budget doesn’t reflect Texas values. It reflects progressive budget ideology:

- Massive increases in state-funded programs with little accountability;

- A $13.6 billion increase in Foundation School Program spending;

- $82.6 billion for Medicaid, up $6.2 billion over the last biennium;

- $39.9 billion for TxDOT and $3.4 billion for border security;

- $10.4 billion on behavioral health, including $6.5 billion outside Medicaid;

- Higher education formula hikes, expanded CPS and TRS benefits, and $12.5 billion in 2024–25 supplemental appropriations.

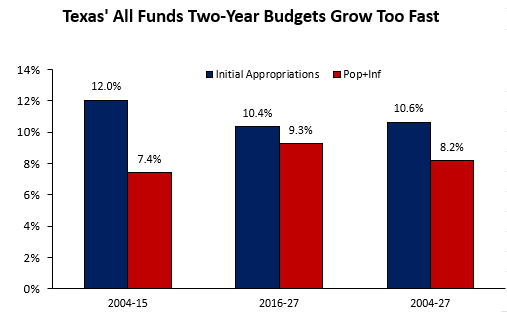

Worse, this budget would further worsen the deterioration of fiscal discipline under Governor Abbott’s watch. For much of the last decade, there was at least some effort at spending restraint. But this budget blows through those limits. Since Abbott’s first budget in 2016–17, Texas’ all-funds budget has grown far faster than population plus inflation.

In fact, since the first Republican trifecta in 2003, Texas looks to overspend by nearly $60 billion more in the 2026-27 budget than what would have occurred had budgets followed pop+inf.

This is unacceptable and underscores how this budget weakens the Governor’s legacy of restraint.

A Warning About November: Constitutional Amendments

As if this weren’t enough, lawmakers have lined up a slate of new constitutional amendments for the November ballot—each proposing to dedicate billions more of taxpayer money for favored projects outside the already weak spending limit. Voters should reject these amendments.

These dedicated funds are deliberately structured to bypass the state’s current spending restraints. This is a transparent effort to bake big-government growth into the Constitution. If successful, it will further erode the Legislature’s ability to prioritize, leading to budget chaos.

The solution? Strengthen the constitutional spending limit to cover at least all state and local spending, ideally all funds, and tie them to a maximum growth rate of population plus inflation, with no loopholes and a three-fourths supermajority vote required to exceed it with surpluses returned through lower tax rates. Anything less invites more backdoor spending and fiscal irresponsibility.

Conclusion

This budget fails the test of stewardship. It overcommits future legislatures and taxpayers. It locks in massive baseline growth that will be difficult to reverse.

And it sends a dangerous message: that the Texas model is no longer one of limited government, but of California-style excess wrapped in conservative rhetoric.

Texans deserve better.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!