Federal

The Ginn Economic Brief: U.S. Economic Situation-October 2024

Big Government Is Holding America Back America’s federal debt has now skyrocketed past $35 trillion—an increase of $2.3 trillion in just the last fiscal year. Inflation persists, with core prices rising 3.3% over the past year. Meanwhile, government jobs are…

The Ginn Economic Brief: U.S. Economic Situation—March 2024

Highlights Figure 1: Real Average Weekly Earnings Remain Down 4.2% Since January 2021 Source: Fed FRED Labor Market The Bureau of Labor Statistics recently released its U.S. jobs report for February 2024, which was another mixed report with some strengths…

Federal Budget Deficit Has Nearly Doubled Under President Biden

The federal budget deficit has doubled from one year to the next a few times before. Usually, those occurrences happen in conjunction with economic bad news, something the current administration consistently says does not exist. The Numbers Game First off,…

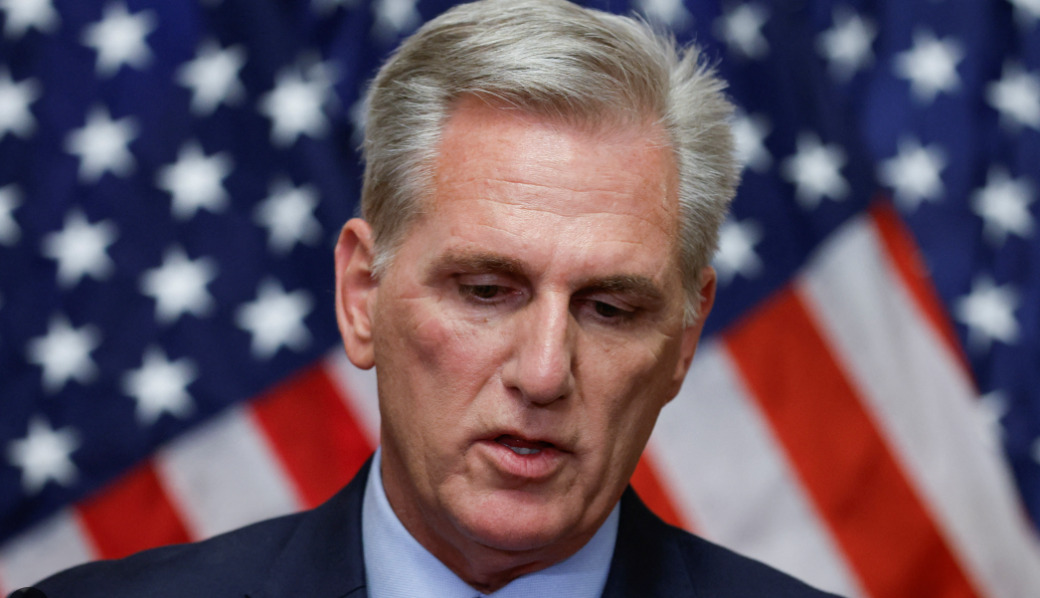

Stopgap Passage Results In Vacating McCarthy’s Speakership

In recent developments, the budgetary decisions and the political maneuvering in the U.S. Congress have taken an unforeseen turn, spotlighting the fiscal discourse that underpins our nation’s governance. The passage of the stopgap resolution, a temporary measure to prevent a…

Federal Reserve Holds Steady

The Federal Reserve holds interest rates at current levels, but the future outlook is more uncertain. At their September meeting held last week, The Federal Reserve’s “Federal Open Markets Committee” (FOMC) declined to increase Federal Funds Interest Rates further and…

Why the August Jobs Report Adds Up to a Weak Economy

This commentary was originally published at EconLib here. It is being republished with permission from the author. Americans say the economy is the most important problem facing the country. But major headlines covering the latest jobs report for August do their best…

Federal Reserve’s Upcoming September Meeting

Rate Hike Speculation and Recession Concerns for 2024 On Tuesday and Wednesday of this week, the Federal Reserve’s Federal Open Market Committee (FOMC) will meet to discuss the state of the US economy, the ongoing threat of inflation, and possible interest…

Stop the Spending Spree: US Freedom Caucus Opposes Status Quo as Possible Shutdown Looms

With the Federal Government’s fiscal year rapidly coming to an end on September 30th, Congress must pass a “continuing resolution,” on spending, or once again face a partial government shutdown. This continuing resolution is essentially a temporary spending bill, using…

In Latest CPI Release, Inflation Rears Its Ugly Head Again

After months of significant declines in CPI inflation, today the CPI (Consumer Price Index) numbers for August showed a resurgence of inflation in the U.S. In August, the CPI rose by 0.6 percent on a seasonally adjusted basis, marking a…

August Jobs Report: Rising Unemployment and Dissatisfaction

The US economy under President Biden continued its mellow pace in August, as Americans continued to strain under the burdens of record inflation, rising interest rates, and economic uncertainty. The U.S. Bureau of Labor Statistics released its raw jobs report…

Another Year, Another Debt Milestone

$33 trillion. Written another way, $33,000,000,000,000. The U.S. National Debt is estimated to surpass $33 trillion in a matter of days. Sadly, milestones like these seem to have become all too regular. Just one year ago I wrote a similar…

The Ginn Economic Brief: U.S. Economic Situation—September 2023

Highlights Figure 1: Year-Over-Year Real Average Weekly Earnings Declined for 26 Months Before Increasing in the Last Three but Remains Down Nearly 5% Since January 2021 Overview Labor Market The Bureau of Labor Statistics recently released its U.S. jobs report…

The Gold-Backed BRICS Currency and the Danger to the Fiat Dollar

Introduction In the realm of global finance and economics, the potential introduction of a gold-backed currency by the BRICS countries—Brazil, Russia, India, China, and South Africa—has gained attention as a potential challenge to the established fiat dollar system. This proposal…

Continued Uncertainty on the Economic Horizon

It has now been more than three years since governments across the country forced us into an artificial recession in response to COVID-19, interrupting some of the greatest economic growth and prosperity under President Trump that America had seen in…

Systemic Struggles: Recent Bank Failures and Their Implications

With all the recent talk of extraterrestrial aliens and Ukraine, you might have missed the recent news story of yet another bank failure in the United States this year. July saw another bank failure in the United States, the Heartland…