Overview

- Texas is a leader in economic freedom and is a place where people move from other states. This “Texas Model” of no personal income tax, relatively less government spending and taxes, and sensible regulation supports robust economic growth and job creation. Voter-approved constitutional amendments that have prohibited personal income taxes and statewide property taxes are contributing to this.

- But this year, the Texas Legislature passed the largest budget increase in Texas history that left just the second-largest property tax cut in the state’s history. Clearly, there is more to do. People cannot claim their God-given right to own property, as they continue to rent their property from local governments. There are ways to correct this, starting with spending less.

- Many of Texas’ more than 4,500 local governments have increased spending and property taxes to unsustainable, unaffordable amounts. Not only are taxpayers burdened, but Texas’ localities look more like big-government municipalities in blue states, such as California. Additionally, the state has risked declining in economic freedom, competitiveness, and prosperity. The Lone Star State will lose its competitive advantage without spending less and eliminating property taxes.

- This report examines the spending, debt, and property taxes in four of Texas’ largest cities, Dallas, Austin, Houston, and San Antonio, where one out of every five Texans live. Historically, these localities have had too much spending, debt, and taxes, which indicate the urgent need for local government reforms before Texas becomes less competitive and less affordable.

Debt

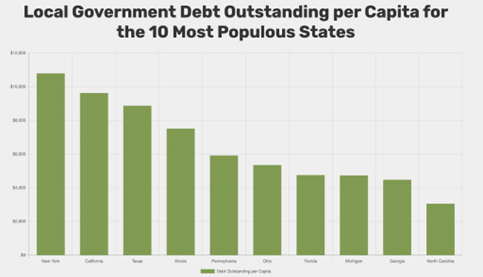

A recent report by the Texas Bond Review Board notes that Texas’ total outstanding local government debt is $280 billion, resulting in debt per capita of $8,869. This puts Texas’ local debt per capita in third place of the largest 10 states, behind only New York ($10,788) and California ($9,621), and nearly twice as high as in Florida ($4,753) (Figure 1).

Figure 1: Local Government Debt Per Capita Is Third Highest in Texas

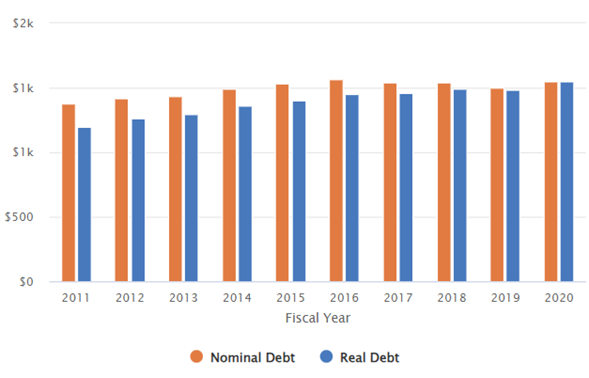

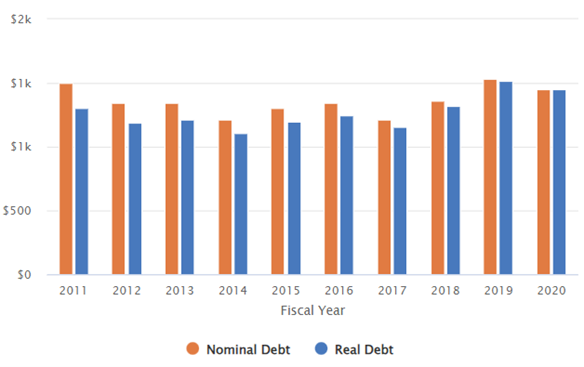

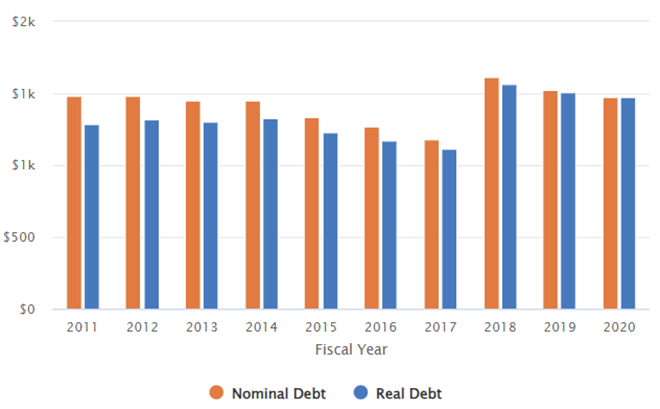

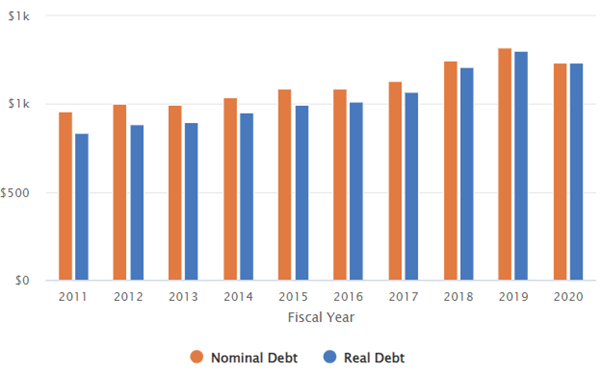

The following figures show the Texas Comptroller’s data for nominal and real (inflation-adjusted) outstanding general obligation (GO) debt for four of the largest cities in Texas (Austin, Dallas, Houston, and San Antonio). Each of them shows increased GO debt per capita from 2011 to 2020 in nominal and real amounts. But these amounts per capita show some differences.

Figure 2: Austin’s Nominal and Real Outstanding General Obligation Debt Per Capita

Figure 3: Dallas’ Nominal and Real Outstanding General Obligation Debt Per Capita

Figure 4: Houston’s Nominal and Real Outstanding General Obligation Debt Up Since 2011

Figure 5: San Antonio’s Nominal and Real Outstanding General Obligation Debt Up Since 2011

- Austin’s debt per capita increased by 12.4% to $1,548 (the largest of these four) in nominal terms and by 29.3% in real terms.

- Dallas decreased debt per capita by 3.5% to $1,447 in nominal terms but increased it by 11.1% in real terms.

- Houston decreased debt per capita by 0.5% to $1,476 in nominal terms but increased it by 14.5% in real terms.

- San Antonio increased debt per capita by 28.9% to $1,237 in nominal terms and by 48.3% in real terms.

The unsustainable deficit accumulation across many of Texas’ local governments reflects irresponsible spending. Economist Michael Munger called this “Deficits Are Future Taxes” (DAFT), meaning, increased debt signals a current spending issue and a future taxation problem for the next generations. This is a significant challenge for the state’s future and drives up property taxes higher than otherwise.

Spending

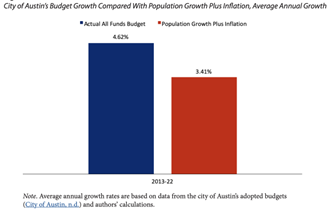

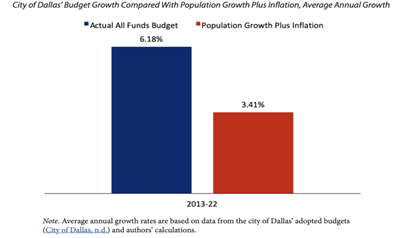

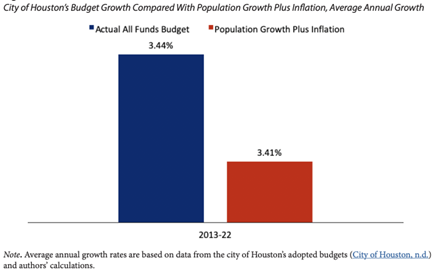

My analysis in June 2022 found that Texas’ four major cities have exceeded a responsible city budget for years, contributing to higher taxes and debt. This responsible budget sets a maximum threshold based on the average taxpayer’s ability to pay for it, which is best represented by a fiscal rule of a spending limit with the rate of population growth plus inflation. Of course, this growth is a maximum as the budget really should be frozen or even cut for most governments given their spending excesses over time. Truth in Accounting defines the local taxpayer burden as,“the approximate dollar amount that would be required of each taxpayer in order to pay off all of a government’s liabilities today. It is calculated by dividing the ‘money needed to pay bills’ by the estimated number of taxpayers in the state or city,” demonstrating the depth of debt.

- Austin was spending at least $2.2 billion more in 2022 because of overspending compared with if it had followed this fiscal rule since 2013 (Figure 6). Truth in Accounting’s 2023 financial report gave Austin a D grade because of the nearly $3 billion in liabilities and $9,400 in taxpayer burden. Clearly, there is much work to do to limit government which is contributing to the unaffordability in Austin.

Figure 6: Austin’s Budget Growth Compared With Population Growth Plus Inflation, Average Annual Growth

- Dallas was spending at least $3.4 billion more in 2022 than if the city had just matched this fiscal rule each year since 2013 (Figure 7). Truth in Accounting’s report shows that Dallas received a D grade with nearly $6 billion in liabilities and $14,700 in taxpayer burden.

Figure 7: Dallas’ Budget Growth Compared With Population Growth Plus Inflation, Average Annual Rate

- Houston was spending $2.7 billion more in 2022 than if it had not exceeded this fiscal rule since 2013 (Figure 8). Truth in Accounting’s 2023 financial report showed Houston’s liabilities reached $6 billion, and the taxpayer burden is $8,900. This results in a grade of D by Trust in Accounting.

Figure 8: Houston’s Budget Growth Compared With Population Growth Plus Inflation, Average Annual Growth

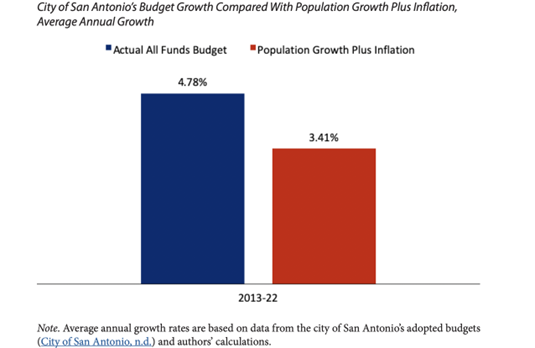

- San Antonio was spending $1.3 billion more in 2022 than if it had spent no more than this fiscal rule since 2013 (Figure 9). Truth in Accounting’s 2023 financial report revealed San Antonio had a C grade with liabilities at nearly $708 million and a taxpayer burden of $1,700.

Figure 9: San Antonio’s Budget Growth Compared With Population Growth Plus Inflation, Average Annual Growth

When local governments want to spend more given their balanced budget requirements, they must raise taxes, and they primarily raise property taxes.

Tax Revenue

The Texas Comptroller reports that property taxes are the biggest revenue source for local governments. Here are the current total property tax rates for these large cities:

- Austin’s current property tax rate is 44.58 cents per $100 valuation of property, which is the effective property tax rate in Austin and one of the nation’s highest.

- Dallas’ current property tax rate is 74.58 cents per $100.

- Houston’s current property tax rate is 55.00 cents per $100.

- San Antonio’s total property tax rate for 2023 is 54.16 cents per $100.

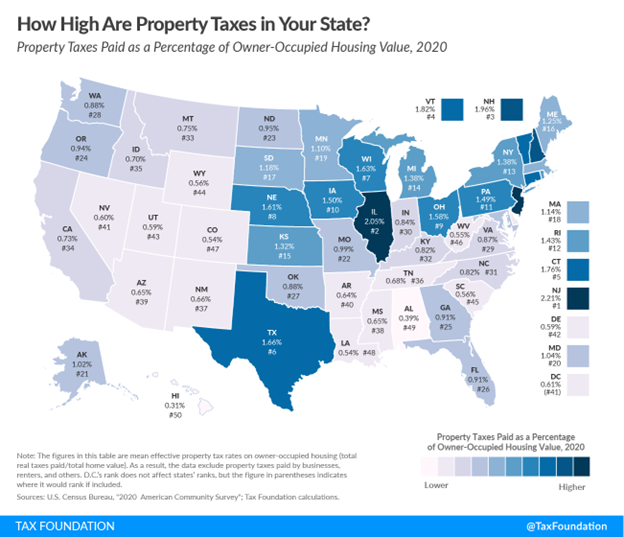

According to the Tax Foundation, Texas currently has the sixth-highest property tax burden on those with a home in the country (Figure 10)

Figure 10. Texas Ranks 6th Most Burdensome Property Taxes for Those with a House

Although the Lone Star State has no income tax, its substantial property tax burden increases because of excessive local government spending increases in recent decades has burdened renters and holders of a home, reducing the state’s affordability. The Tax Foundation’s state business tax climate ranks Texas 38th out of 50 for the burden of property taxes.

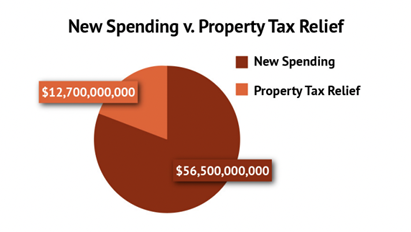

The Texas Legislature recently passed and Governor Greg Abbott signed Senate Bill 2 with $12.7 billion in property tax relief. This package includes reducing the school district maintenance and operations (M&O) property taxes by 10.7 cents per $100 valuation. It also includes raising the homestead exemption for school district property taxes by $60,000 to $100,000. However, this package should have been much larger, as there were $33 billion in surplus funds available and tens of billions of dollars more available, leaving plenty of taxpayer money to return. The property tax bills provided further complicate the tax system and will not result in as much relief as some are advertising. The best approach was to reduce school district M&O property tax rates with all the relief provided. This should have been at least $21 billion for a reduction of 25 cents per $100 valuation. This would have provided the largest property tax cut in Texas history (Figure 11) instead of the second largest because of the largest spending increase in the state’s history.

Figure 11: New Spending v. Property Tax Relief

Recommendations

For the state to stay competitive and improve the future for Texans, Texas should seek to reform the largest hindrances to its economic flourishing: government spending and property taxes.

- State government must spend less and eliminate school district M&O property taxes. Texas has done a better job restraining spending than many states, but more must be done, especially after this year’s spending bonanza. By controlling spending better and passing a Frozen Texas Budget, the Legislature can use surplus funds to buy down school district M&O property tax rates each period until they are zero. This tax is essentially controlled by the Legislature now with the school finance formulas, so it is best positioned for the state to eliminate it. This process for elimination would take about ten years, based on conservative estimates, for the state to fund 100% of the state’s school finance formulas as intended by the Texas Constitution (Article VII, Section 1).

- Local governments must spend less and eliminate their property taxes. This should at least include imposing a responsible local budget that increases by no more than the rate of population growth plus inflation. Local governments could impose this on themselves, or the state could pass a law that would extend the state’s spending limit based on this rate for all local governments. It would force municipalities to prioritize spending better and make essential modifications or cuts where needed, and it would protect taxpayers from higher property taxes to fund excessive spending. Doing so would result in surpluses at the local level because tax revenues from sales taxes and fines and fees generally increase faster than this fiscal rule. The surpluses should be returned to taxpayers by buying down their own property taxes until they are zero, which could also take about a decade. Localities that cannot do this with other revenue sources or choose not to do so should substantially reduce their property taxes to compete with other localities. Over time, this process of competition would help eliminate all property taxes in Texas or many local areas will be left behind.

- The Legislature should freeze school district M&O property taxes and reduce the voter approval rate for all taxing entities to the no-new-revenue rate for new and existing properties without loopholes. This will help to more quickly eliminate these property taxes and put more power in the hands of taxpayers.

- State and local governments should increase transparency for debt and property taxes. There has been more transparency added to debt and property taxes in recent years, but more is needed. For example, any debt issued should have the amount of taxes being raised to pay for the debt in total and for the average homeowner in that locality. There should also be caps on how much debt can be issued, as this is just current and future tax hikes.

Conclusion

The ultimate burden of government is not how much it taxes, but how much it spends. This is true at the national, state, and local levels. Texas boasts many metrics of economic freedom, including no personal income taxes, less burdensome regulations, and relatively less government spending. Recent increases in these areas hinder opportunities to prosper. Immediate policy changes to state and local budgeting that will eliminate property taxes, increase transparency for budgets, debts, and taxes, and strengthen their fiscal situation will help Texas better support prosperity for Texans today and for generations to come. Moreover, this will finally give Texans their God-given right to own property instead of renting from the government forever. Stop renting, start owning!

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!