An Overview

- Texans face an affordability crisis from not only bad policies out of Washington D.C. but also excessive government spending at the state and local levels, resulting in higher taxes than otherwise.

- While state and local governments cannot change President Biden’s costly regulations, Congress’ excessive deficit-spending, or the Federal Reserve’s over-printing of money, they can spend and tax less in Texas.

- To overcome these economic headwinds, state and local governments should pass frozen (no-growth) budgets, impose the no-new-revenue rollback rate on property taxes, and return at least 90% of excess tax collections stolen from taxpayers to compress property tax rates until they are zero.

- Achieving this will help Texans with the affordability crisis and make Texas an economic juggernaut so that more people can prosper.

Texans for Fiscal Responsibility’s 3-Step Plan to Eliminate All Property Taxes

- Frozen State Budget of holding spending growth to zero so there is less government intrusion in the private sector resulting in a maximum surplus available to provide property tax relief.

- Eliminate School District M&O Property Taxes with 90% of state surplus funds each biennium until nearly half of the total property tax burden is zero in just four years.

- Eliminate Other Property Taxes by passing a local spending limit, imposing the no-new-revenue rollback rate, and using 90% of local surpluses to buy down their property taxes until they are zero.

While Texas has done a better job at keeping spending and taxes lower than many other states, thereby supporting a more robust business tax climate and more economic freedom, there has been too much growth in state spending and local spending over the last 20 years. This has contributed to higher taxes, and if it is not reversed quickly, the state will be less competitive than that of other states and there will be fewer opportunities for Texans to improve their standard of living. This is why we propose a frozen state budget to stop the excessive spending as outlined in Table 1 below.

Table 1

Frozen Texas Budget (Millions of $)

| Source of Appropriations | 2022-23 Appropriations | 2024-25 Frozen Budget |

| General Revenue Funds | $119,154.1 | – |

| General Revenue Dedicated Funds | $6,319.9 | – |

| General Revenue-Related Funds | $125,474.0 | $125,474.0 |

| Other Funds | $40,799.1 | – |

| State Funds Total | $166,273.1 | $166,273.1 |

| Federal Funds | $98,531.6 | – |

| All Funds Total | $264,804.7 | $264,804.7 |

This frozen budget results in a growth of zero from the 2022-23 biennial budget to the 2024-25 biennial budget with the maximum appropriations of $125.47 billion in general revenue-related (GRR) funds and $166. 27 billion in state funds. We focus on these two sources of appropriations because GRR funds are most related to which funds can be used for tax relief and which funds lawmakers have the most control over. But, given that the all-funds budget is the full footprint of government in people’s lives, we should also hold the line in total appropriations.

There is room for growth in government spending for the limited roles of government outlined in the Texas Constitution. Many expenditures in the 2022-23 budget were for one-time items, which should be zero in the 2024-25 budget; this would leave funding available for necessary appropriations. But this does mean that the state will need to be fiscally prudent with every taxpayer dollar and scrutinize every expenditure through sound budget processes of performance-based budgeting, zero-based budgeting, and audits of programs to see which should stay or go.

Texas families do this every month; the state should be even more fiscally conservative than the families it serves, as it is not their money.

Property taxes dominate revenue collected (around 80%) to local governments in Texas from all types of property.

There are four major local taxing jurisdictions of independent school districts, special purpose districts (e.g., municipal utility districts), counties, and cities. These local taxing jurisdictions can impose two types of property taxes: maintenance and operations (M&O), which fund the day-to-day expenditures, and interest and sinking (I&S), which fund debt to support capital projects.

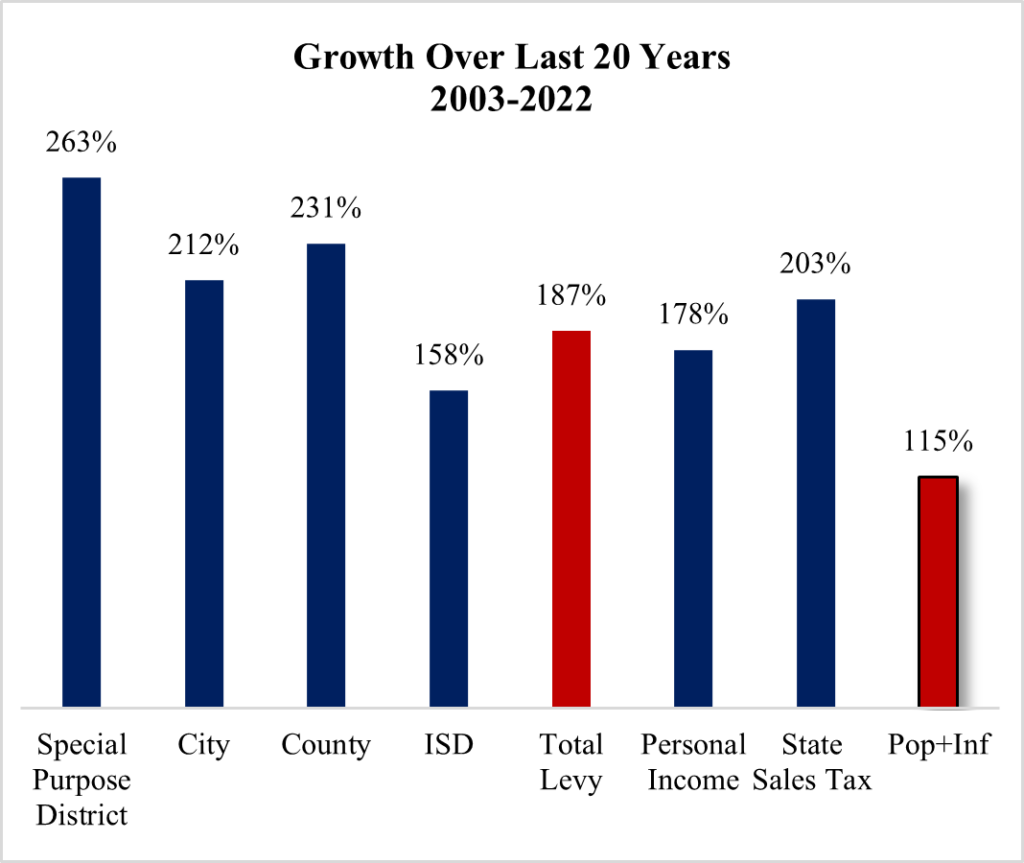

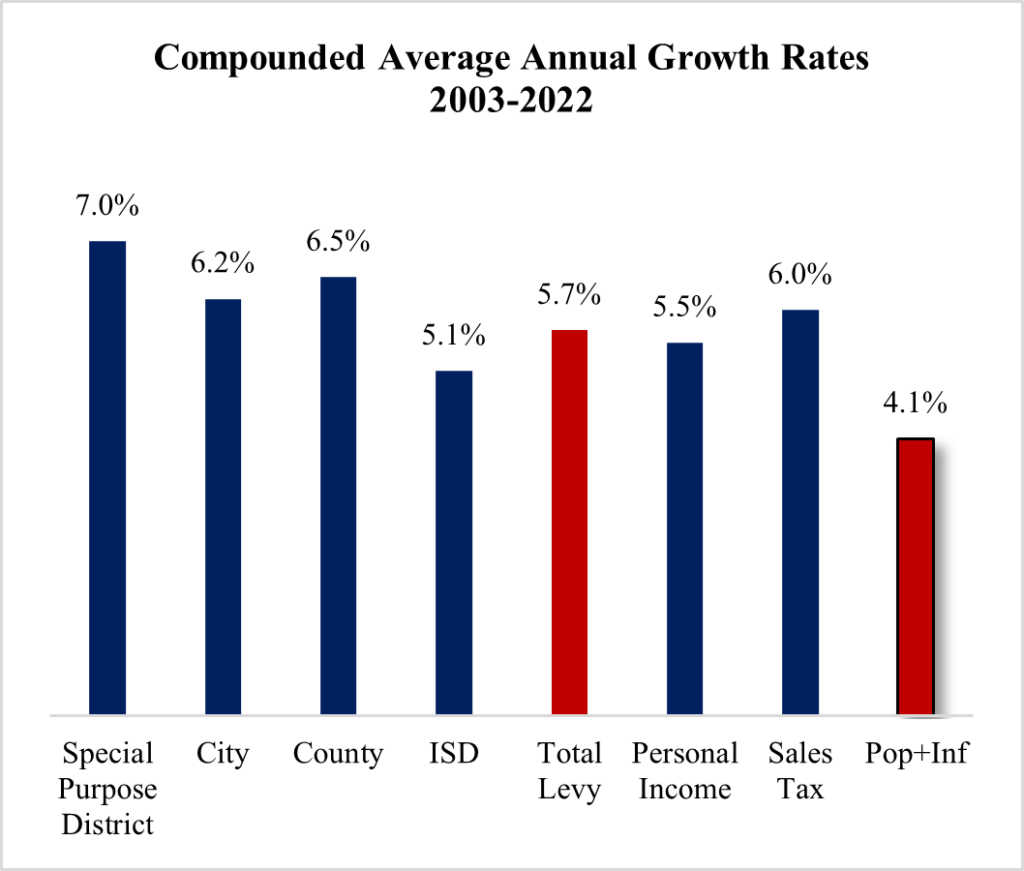

Based on the latest data available from the Texas Comptroller’s website, Figure 1 (below) provides information on the growth and compounded average annual growth for the last 20 years in total property taxes collected (i.e., M&O and I&S) by these tax jurisdictions. Compared with state sales tax growth and economic measures of personal income growth and the rate of population growth plus inflation, these tax jurisdictions have grown excessively, contributing to the affordability crisis in Texas.

Figure 1

Increase Growth Rates in Taxes and Economic Measures Over the Last 20 Years

State Should Eliminate School District M&O Property Taxes

The Texas Comptroller recently announced that the Legislature has an estimated $32.7 billion surplus in GRR available at the end of the current 2022-23 biennium, which ends in August 2023. This historic amount of surplus should be returned to taxpayers, and the best way to do that so all Texans can feel it and improve the affordability crisis is to compress the school district M&O property tax rates.

These taxes are the best target for relief from the state because the Legislature controls most of school funding with its school finance formulas. These property taxes are local mostly in name only, so there should be an explicit funding component that matches the state’s Constitution and state law for the Legislature to fund 100% of school districts’ day-to-day operations based on the school finance formulas.

This does not mean public schools should get more funding than what they are set to get in law, but it does mean they would not necessarily receive less money unless the Legislature chose to change the school finance formulas, which should be on the table given students are fleeing public schools with poor outcomes.

Given the frozen GRR budget for the state and the expected revenue in the 2024-25 biennium, there could be an estimated $62.8 billion in surplus available in that biennium, as noted in Table 2.

Table 2

Example of Surplus GRR Buydown Proposal if Started in 2024–25 (in Millions of Dollars)

| 2022-23 | 2024-25 | 2026-27 | |

| Revenue (9.3% increase) | $158,160 | $188,226 | $205,779 |

| Spending (0%) | $125,474 | $125,474 | $125,474 |

| Surplus (Revenue – Spending – Maintaining Cuts) | $32,686 | $62,752 | $23,828 |

| Surplus Available for School District M&O Property Tax Cuts (90% of Surplus) | $56,477 | $21,445 | |

| Surplus Remaining | $6,275 | $2,383 | |

| School District M&O Property Taxes (No New Revenue Rate) | $67,806 | $11,329 | $0 |

And with the use of 90% of that surplus, similar to House Bill 90 in the third special session of the 87th Legislature and House Bill 985 in the regular session of the 88th Legislature, there can be a substantial GRR surplus available to provide historic property tax relief of about $56.5 billion in the 2024-25 biennium.

There is an estimated $67.8 billion in school district M&O property taxes collected in the 2022-23 biennium. If those property taxes are appropriately frozen, then the entire $56.5 billion can be used to compress the property tax rates such that there is only $11.3 billion collected in the 2024-25 biennium. If this approach is done in just one more period for the 2026-27 biennium, there can be another GRR surplus of $23.8 billion after funding the budget and maintaining the prior property tax cuts to give a 90% amount of $21.4 billion for new property tax compression. With just $11.3 billion left in school district M&O property taxes, this amount of GRR available for tax relief would force these property tax rates to zero in 2026; if this occurs, 2027 would be the first year without nearly half of the property tax burden in Texas.

The result would be a shift to funding 100% of M&O in public schools by the state through primarily sales taxes, which mostly fund the state government. This would provide more liberty for Texans who can start to own more of their property instead of renting everything from the government by paying property taxes, and it would also support more economic growth. In fact, researchers at Rice University’s Baker Institute have found that the result of this pro-growth, pro-liberty policy proposal would lead to substantial economic growth and prosperity.

But the benefits of this approach should not stop there. Ultimately, the immoral, burdensome, costly wealth tax known as property taxes should be eliminated entirely. The way to do this is by limiting both state spending and local spending. This should be done by passing a spending limit on all local governments that would cover all spending from all revenue sources, with the growth limited to the state’s population growth and inflation as specified in the state’s new spending limit (Senate Bill 1336, passed in 2021).

Following the state’s new, improved spending limit will provide a consistent spending limit across the state; so, no matter where one wants to live in Texas, there would be a restraint on how much taxes can go up over time. And the excessive spending by local governments in the past means that they should not spend up to that limit but should instead have a frozen local budget. In addition, the rollback rate on property taxes should be reduced to the no-new-revenue rate. This would provide an additional safeguard to hold local governments accountable to the people for raising taxes.

By using these reforms, local governments will likely collect more taxes than what can be spent, so local governments should use 90% of the resulting surplus to compress their own M&O property taxes until they are zero. After they have done this, local governments could use the surplus to also pay off their I&S property taxes, thereby eliminating all property taxes in the state with the focus being restraining spending, which is the true burden of government.

Conclusion

Texas should eliminate property taxes. This process ought to start now when the state and local governments are flush with excessive cash collected from taxpayers who are burdened by an affordability crisis.

By following Texans for Fiscal Responsibility’s three-step process of passing a frozen state budget, using 90% of surplus dollars to compress school district M&O property tax rates until they are zero, and having local governments eliminate the rest of their property taxes, Texas can eliminate property taxes soon.

Some will say this is unrealistic. But as President Reagan asked, “If not now, when? If not us, who?” Let this be the time, and let us be the ones. Texans deserve it.