According to CPI data released today, inflation has hit a 30 year high at 6.2% year over year. This has officially killed the narrative that “inflation is transitory” and will magically disappear according to the Federal Reserve. But what is inflation and why is it bad? What has caused this dramatic increase in inflation? What does this mean for Texans? This article will attempt to answer all of these questions.

What Is Inflation?

Inflation is the decline of purchasing power of a given currency over time. A quantitative estimate of the rate at which the decline in purchasing power occurs can be reflected in the increase of an average price level of a basket of selected goods and services in an economy over some period of time (CPI). The rise in the general level of prices often expressed as a percentage, means that a unit of currency effectively buys less than it did in prior periods.

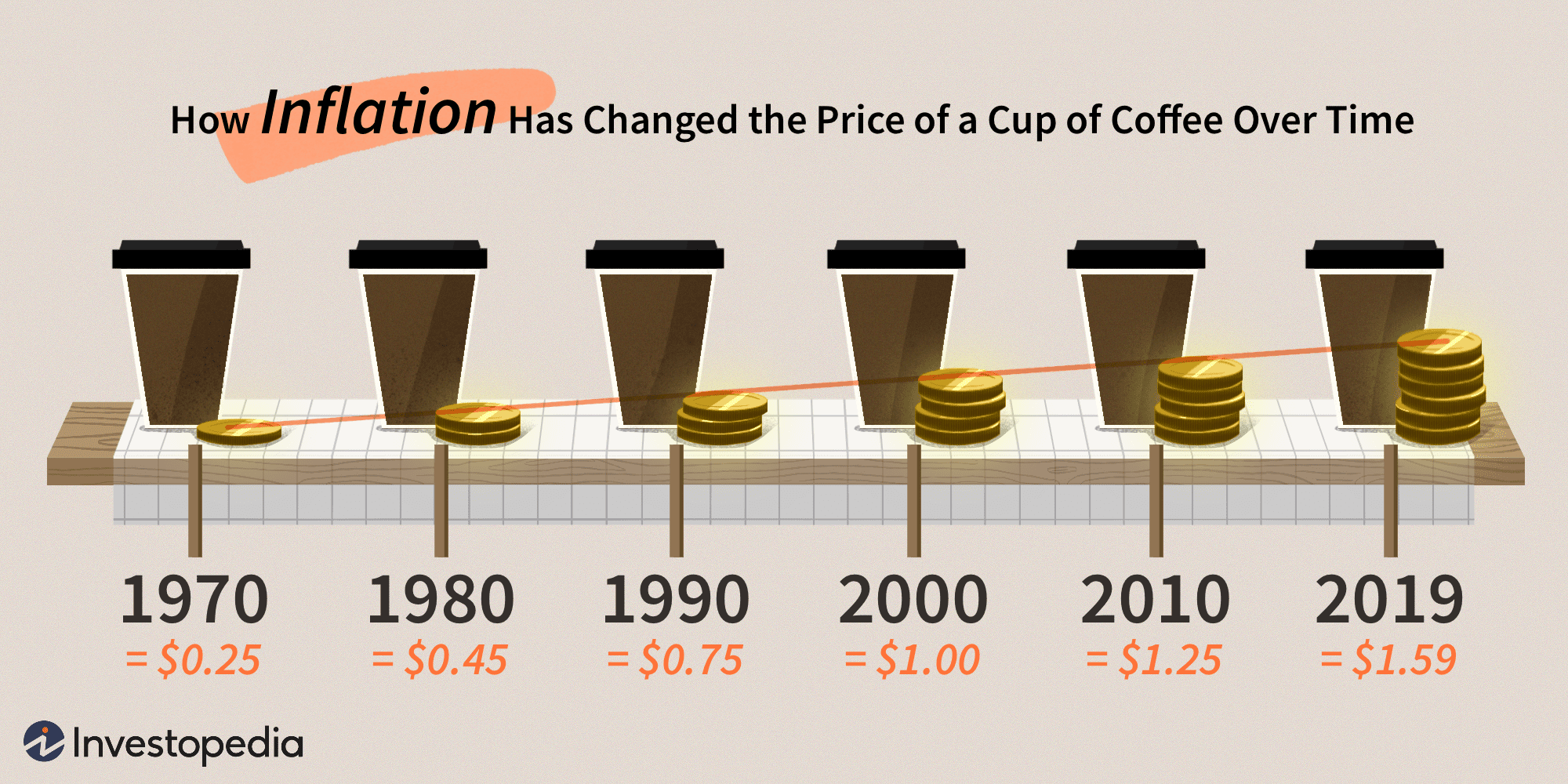

What does this mean in plain English? Inflation is the loss of value of our dollar. An example is when your grandfather would tell you about the good ole days when he could get a Dr. Pepper for 5 cents. Now Dr. Peppers are over a dollar or even two. What has occurred? Has Dr. Pepper gone up in value over time? No. Our dollar has lost that much value over time. Tangible goods are how inflation is measured in the CPI. While it is true that products can increase because a number of factors, especially increased demand or supply shortages, most long-term price increases are largely inflationary.

Why Is Inflation Bad?

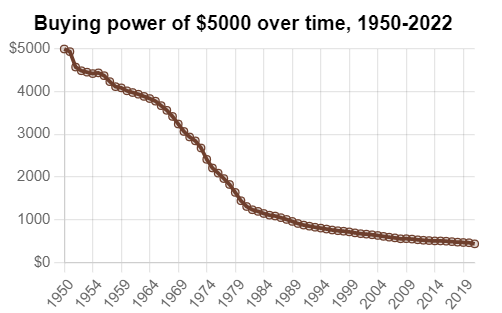

Inflation is bad because it is essentially an invisible tax on our income and savings. Salaries tend to stay roughly the same, but inflation causes that same salary to purchase less and less over time. The same goes for savings, $5000 in savings in 1950 would be roughly the equivalent of $58,618.11 today. This means that if you held that same $5000 without investing it, its value would be $433. That is a staggering number.

This means that according to the latest CPI data, everyone in America has lost roughly 6.2% of the value of their current savings over the last year. If you had $100,000 saved a year ago, it is now worth $93,800. By the chart above it is easy to see just how quickly inflation can compound driving money to be more and more worthless over time. With historic rates of inflation occurring the loss in value will be even more dramatic. The Federal Reserve strives to keep inflation around 2%, so numbers above that will have an adverse effect on the dollar’s value more quickly.

What Causes Inflation?

Inflation can be caused by a few different factors and economists would argue over those factors depending on the school of economics they adhere to (i.e. Austrian vs Keynesian). Different economic systems will be covered in future articles. TFR believes that the inflation we are seeing today is a direct result of Modern Monetary Theory and the use of unlimited money printing. In simple terms Modern Monetary Theory teaches that sovereign nations that control their own supply of money do not have to rely on taxes or borrowing for spending, they can simply print more money. MMT is used often by leftists when advocating for things like universal healthcare or free college. According to them, there is no reason to worry about the cost of these socialist policies when we can just print more money out of thin air!

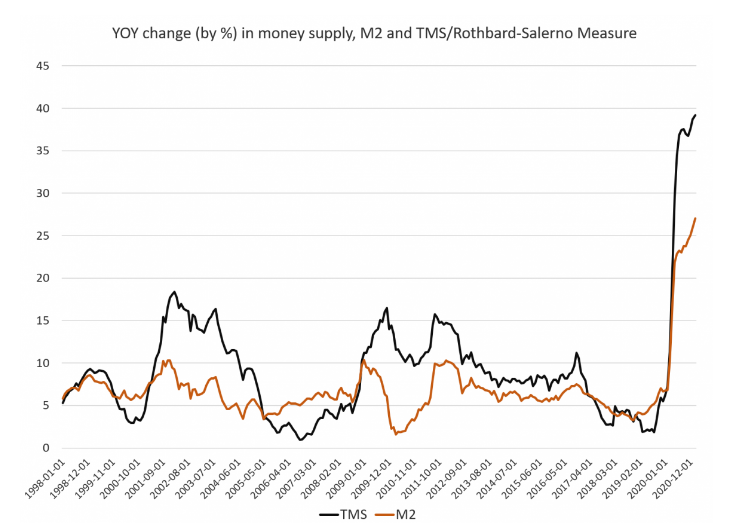

This is easily refuted when we look at the most basic principle of economics: supply and demand. If a currency is fiat (not tied to anything of value such as gold) then its value is largely based on the amount in circulation. Supply and demand are inversely related which means that as the supply of the US dollar increases the demand for it will do down. With lower demand value tends to decrease. This is what we are seeing in real-time and it is a direct result of the insane amount of stimulus money printed by the government in response to COVID lockdowns (which they also caused).

At the end of 2020, we increased the money supply of the US dollar by 40%. Of course, the money printing did not stop there and has continued this year with the irresponsible monetary policy of the Biden administration. The recently passed $1.2 trillion dollar infrastructure bill could just be the first part of the “Build Back Better” plan with the “social infrastructure” portion coming soon (lots more free money for all).

What Can We Do?

On a personal income level, the only thing that you can do is invest your money in hopes to outpace inflation. According to the most recent number you would need to be making over 6.2% gains yearly to make sure your money stayed the same value. Debt is also positively affected when money inflates so many choose to invest in real estate since over decades the debt becomes more and more worthless. However, the most important thing we can do as citizens is to fire all politicians that have voted for the unlimited printing of fiat currency. We need sanity when it comes to US monetary policy, something that seems exceedingly rare nowadays. Voters would be wise to keep the fiscal policy in mind as we head into the primary season next spring.