$30 trillion. Written another way, $30,000,000,000,000.

It is a number that is generally unfathomable and difficult to truly understand or conceptualize by everyday Americans. It also represents the money owed by the United States Government or more importantly the taxpayer to themselves (i.e. future generations), businesses, pension funds, liabilities that one portion of the government owes to another, and other sovereign countries.

It is an almost insurmountable burden on the prosperity of future generations and what is worse, is that our political leaders have seemingly no appetite for course correction.

In truth, that number casts a facade over the even more frightening unfunded liabilities or promises the U.S. Government has made for users of programs like Medicare, Social Security, and other pension or retiree health care. Though that number seems to vary depending on how it’s calculated and the assumptions used, fiscal watchdogs at Truth in Accounting calculate that number at over $141 trillion.

Bottom Line Up Front

Both major political parties are at fault. The coming days and weeks will be full of political posturing and tribalist rhetoric, but the debt has soared under both Republican and Democrat administrations with both also having the luxury of partisan majorities in the U.S. Congress throughout recent decades to address it.

The debt burden is so large that the government would need to spend more money than the entire American economy to pay it off.

As the debt grows, so too does the interest accrual, making it even more costly to pay back.

Visualization Help

It would take 31,710 years to count just 1 trillion seconds of time. If you spent $1 million per day since the day Christ was born, you would still have not spent $1 trillion by today.

For additional visualizations, the folks at Demonocracy have provided some interesting comparisons.

Important Distinction Between Debt and Deficits

Put simply, a deficit is when the government spends more than it collects. In response to this phenomenon, the U.S. Treasury finances deficits to allow the government to continue operating by borrowing money from investors who reside both domestically and abroad while also selling securities to financial institutions, corporations, and governments around the world. It also borrows money from international financial organizations.

The national debt is a representation of the total amount of money owed to those creditors.

In 1917, a debt limit mechanism was established which required that any additional spending above established limits be approved by the U.S. Congress. In practice, however, Congress has raised the debt ceiling in attempts to avoid default, a lowering of credit rating, and an increase in the cost of ongoing debt.

The Debt Over Time

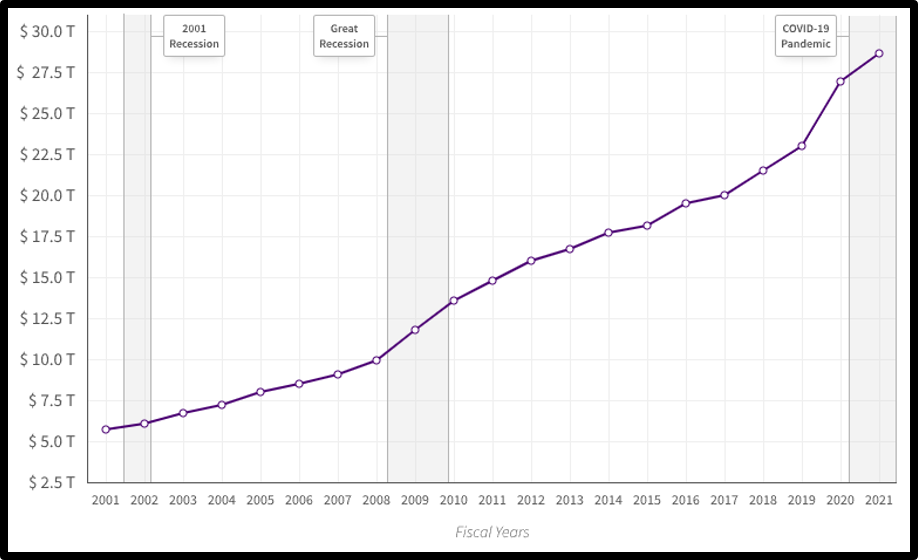

According to USAspending.gov (chart below), in 2001, the debt sat at just over $5 trillion, gradually increasing to about $10 trillion in 2008. In the midst of what became proverbial known as the “Great Recession” the trajectory of the debt began increasing at a faster pace thereafter.

In 2017, under President Trump and with a Republican majority in Congress, a $1.5 trillion tax cut was passed which also included additional federal spending, further accelerating the rate of increase on the debt.

Before the outset of the COVID-19 pandemic, the U.S. Congressional Budget Office projected that the national debt would reach $30 trillion near the end of 2025. Increased spending in response to the pandemic allowed us to reach that milestone at a faster rate. In December of 2021, Congress agreed to once again raise the debt ceiling to nearly $31.4 trillion. This followed the almost $2 trillion pandemic relief package passed earlier in 2021 in purported attempts to protect the economy from further damage.

Runaway spending has consequences, however. Much of that has manifested itself in the form of historic inflation not seen in nearly 40 years, causing the costs of everyday goods to skyrocket, further burdening American families.

Broken Down – Who Do We Owe?

Of the over $30 trillion of debt, over $22 trillion of it is held by the public. The remainder is held by intergovernmental agencies.

Of the $22 trillion in public debt, foreign and international investors hold over $7 trillion. State and local governments hold over $1 trillion and a mixture of mutual funds hold nearly $4 trillion. The remainder of the $22 trillion includes U.S. savings bonds, private pension funds, insurance companies, banks, and other investors.

Intergovernmental agencies primarily make up the difference. By far, the largest of which is Social Security which holds nearly $3 trillion in debt and includes the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds. The next largest is that of the Military Retirement Fund at over $1 trillion, followed by an amalgamation of Medicare, the Office of Personnel Management Retirement, and others.

If you break down the total debt by the number of American citizens, those numbers look even more daunting. $30 trillion in debt amounts to over $90,000 per American citizen or almost $240,000 per taxpayer. If you calculate it on the aforementioned unfunded liabilities, each taxpayer’s share is over $900,000 of the debt.

Texas’ State & Local Debt Problem

Not to be forgotten, Texas also finds itself with a growing debt problem.

Of the 6 most populous cities in Texas, none of them have enough money to pay their bills.

The state of Texas itself is considered a ‘sinkhole’ state by Truth in Accounting according to their 2021 State of the States Report. They indicated that Texas needs nearly $107.6 billion to pay their ongoing expenses, which equals about a $13,100 burden on Texas taxpayers.

What Does it All Mean?

Economists are ultimately split as to the long-term effects of such large debt burdens. The only real certainty is that there does not appear to be a reprieve on the horizon, and without much-needed spending limits and a political culture that values fiscal responsibility, the burden of increasing debt and runaway spending will only get heavier on taxpayers.

In the words of Latin writer Publilius Syrus, “Debt is the slavery of the free.”