A reprieve from taxes, however significant, is always welcome news for Texas taxpayers, well… at least for the ones that directly benefit from that reprieve.

At a recent Senate Finance Committee hearing, State Sen. Charles Schwertner (R-Georgetown) inquired about the statistics covering existing exemption amounts to a representative from the Texas Comptroller’s office. The handout in question was the Comptroller’s Tax Exemptions & Tax Incidence Report from December 2020 which indicates, that “the total estimated cost of local school district property tax exemptions or special appraisals is $14.1 billion in tax year 2021. This amount is projected to increase to $18.2 billion by 2026.”

Why is this significant? The tax burden will shift to other taxpayers who do not qualify for those exemptions, and with Texas taxpayers already reeling from ever-increasing property tax burdens, inflation, and higher costs of living, shifting tax burdens to taxpayers who do not qualify for exemptions is unpalatable.

A common misconception by many supporters of exemptions; generally those who qualify and take advantage of them, is that exemptions are beneficial. They are usually used as incentives to attract investment and development, whereby the argument then becomes that it is a net benefit to those in its wake.

At issue, however, is that typically an exemption leads to an increase in the tax burden on taxpayers that do not qualify, no matter how nominal that increase might be. The government very seldomly, if ever, voluntarily gives up a source of revenue, but merely finds it somewhere else.

Texans for Fiscal Responsibility (TFR) is an advocate for the elimination of the property tax altogether, as a part of our recently introduced Texas Prosperity Plan. The current practice of shifting the tax burden and “lowering” or “cutting” tax burdens for certain taxpayers is ultimately unsustainable and the government should never be in the business of picking winners over losers.

Texas does not currently have a revenue problem, it has a spending problem.

To be fair, ‘tax incidence’ or the measurement of the division of tax burden between those being taxed is extremely difficult to calculate objectively, given the subjective nature of selecting which economic and behavioral assumptions weigh into the overall calculation. That being said, it is a safe assumption the burden does ultimately get shifted, merely because government spending as a result of the taxes collected does not go down.

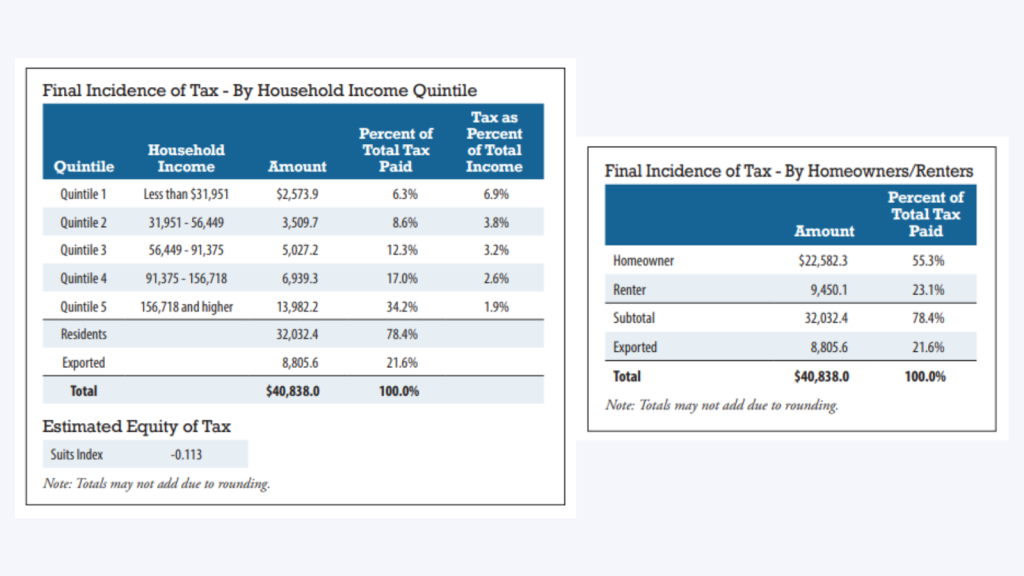

In the aforementioned report, the Comptroller does endeavor to calculate the ‘tax incidence’ as you can see here as well as other broken down charts:

What Are the Existing Exemptions?

Several exemptions exist. You can find a complete list here. The following are the most common:

Residence Homestead Exemption

Current law requires school districts to provide a $40,000 exemption on residence homesteads. In order to qualify for the exemption, the owner of the property “must have an ownership interest in the property and occupy the property as the owner’s principal residence.”

Age 65 or Disabled Persons Exemption

Current law also requires school districts to provide an additional $10,000 residence homestead exemption to Texas property taxpayers who are age 65 and older or disabled. In order to qualify for the exemption, the owner of the property must be age 65 or older and reside in the property.

Disabled Veterans and Surviving Spouses of Disabled Veterans Exemption

Current law allows for partial exemptions for any property owned by disabled veterans and surviving spouses and children of deceased disabled veterans. The amount of the exemption is dictated by the disability rating administered by the U.S. Veterans’ Administration or the individual branch of the U.S. Armed Forces by which the veteran served. Additionally, a disabled veteran can qualify for an exemption of $12,000 of the overall assessed value of the property if the veteran is also 65 or older with a disability rating of at least 10 percent.

Surviving Spouses of First Responders Killed in the Line of Duty Exemption

Current law allows for a total property tax exemption for the residence homestead of a surviving spouse of a first responder “killed or fatally injured in the line of duty if the surviving spouse has not remarried since the first responder’s death.”

What Can Be Done?

Instead of being satisfied with exemptions, taxpayers should demand their lawmakers eliminate the property tax altogether, benefitting all taxpayers.

Though TFR does not advocate for a specific replacement, believing one is not necessary at least in the near term, several alternatives that are fairer and more transparent exist as a means to fund the government.

How can you help? Go read the Texas Prosperity Plan for yourself and voice your support for REAL property tax relief by signing up to support the TPP. Sign up for The Fiscal Note to keep up to date on all fiscal issues that affect Texans, especially our broken property tax system. We CAN get real tax relief if we amplify our voices loud enough.