Recently, Truth in Accounting released its 2022 Financial State of the States Report analyzing the financial health of all 50 states in the United States. They have released this annual report for the past 13 years.

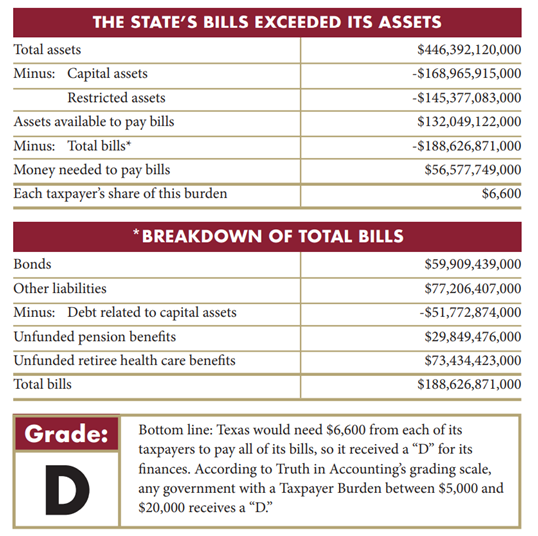

According to the report, Texas would need about $56.6 billion to pay its bills. To put it another way, each Texas taxpayer would need to provide $6,600 to make the state whole. They give Texas a “D” rating and place it 33rd of all 50 states when it comes to its financial health, making it what they consider a “sinkhole” state.

What or Whom is to Blame?

The report states, “Texas’ financial problems stem mostly from unfunded retirement obligations.” It continues by summarizing the market’s volatility and concludes, “Given these facts, the state’s overall debt situation will likely further deteriorate over the coming year.”

The Texas Legislature has merely applied “Band-Aid” fixes to things like the state pension systems over the last few decades.

The report continues:

“Even with these reported increases in pension assets, Texas had only set aside 86 cents for every dollar of promised pension benefits and three cents for every dollar of promised retiree health care benefits. If benefits and funding are not changed, future taxpayers will be burdened with paying the under-funded retirement promises.”

Compared to Other States

The report indicates that 31 of all 50 states did not have enough money to pay all of their bills.

They conclude, “This means that to balance the budget—as is required by law in 49 states—elected officials have not included the true costs of the government in their budget calculations and have pushed costs onto future taxpayers.”

Only three states received a rating of an “A,” or allowing for a taxpayer surplus of greater than $10,000 per taxpayer; 16 received a “B” rating, meaning they allow for a taxpayer surplus of between $100 and $10,000 per taxpayer; 11 received a “C” rating, meaning they provide for a taxpayer burden between $0 and $4,900 per taxpayer; 14 (including Texas) received a “D” rating, which means they provide for a taxpayer burden of between $5,000 and $20,000 per taxpayer; and 6 received failing “F” ratings, meaning they provide for taxpayer burdens of greater than $20,000 per taxpayer.

The report summarizes, “The total debt of the 50 states amounted to $1.2 trillion.”

The complete ranking of all 50 states can be seen here:

- Alaska (A)

- North Dakota (A)

- Wyoming (A)

- Utah (B)

- South Dakota (B)

- Nebraska (B)

- Tennessee (B)

- Oregon (B)

- Idaho (B)

- Oklahoma (B)

- Iowa (B)

- Virginia (B)

- Minnesota (B)

- North Carolina (B)

- Indiana (B)

- West Virginia (B)

- Arkansas (B)

- Florida (B)

- Montana (B)

- Georgia (C)

- Colorado (C)

- Wisconsin (C)

- Nevada (C)

- Washington (C)

- Ohio (C)

- Arizona (C)

- Missouri (C)

- Kansas (C)

- Maine (C)

- New Hampshire (C)

- Alabama (D)

- Mississippi (D)

- Texas (D)

- New Mexico (D)

- Michigan (D)

- Rhode Island (D)

- Maryland (D)

- Louisiana (D)

- South Carolina (D)

- Pennsylvania (D)

- Vermont (D)

- New York (D)

- Deleware (D)

- Kentucky (D)

- California (F)

- Massachusetts (F)

- Hawaii (F)

- Illinois (F)

- Connecticut (F)

- New Jersey (F)

What is Next?

The next legislative session is set to begin in January of 2023. Your elected officials need to hear from you.

How can you help? Go read the Texas Prosperity Plan for yourself and voice your support for banning taxpayer-funded lobbying, eliminating the property tax, and freezing state spending by signing up to support the TPP. Sign up for The Fiscal Note to stay up to date on all fiscal issues that affect Texans, especially our broken property tax system. We CAN put Texas on a path to fiscal sanity and future prosperity if we amplify our voices loudly enough.