As the dust begins to settle from last week’s primary election, an often overlooked aspect of the elections are the propositions at the end of the ballot.

This cycle, the Republican Party of Texas placed 13 propositions on voter’s ballots, asking for important feedback from Texas Republicans.

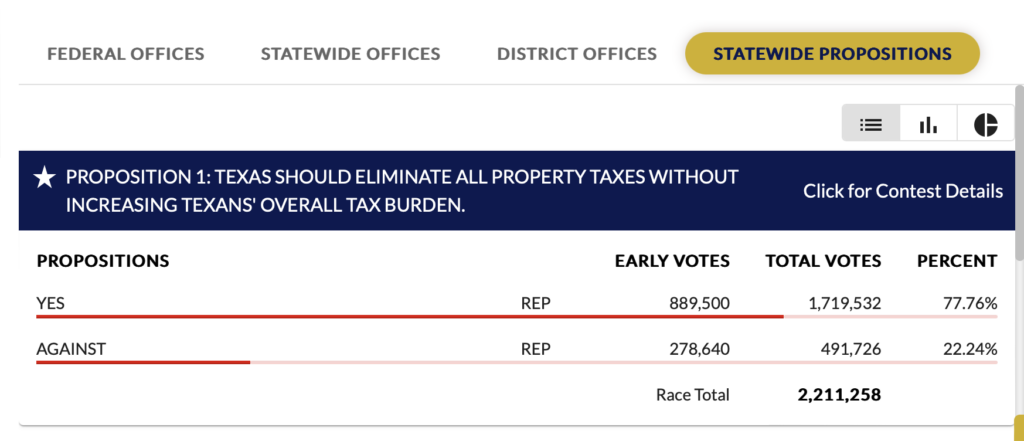

The very first proposition on the ballot asked voters to weigh in on the issue of property taxes, inviting them to respond to the statement, “Texas should eliminate all property taxes without increasing Texans’ overall tax burden.”

What was the response? An overwhelming and resounding YES.

In fact, nearly 78% of voters answered in the affirmative, sending a clear message to Republican lawmakers in Austin: It is time for property taxes to go.

It is quite evident from the election night results that Texas Republican voters are tired of paying perpetual rent to the government.

A property tax has been levied by various governments in Texas since before the Texas War for Independence, and the State property tax was not completely abolished until 1982.

Texans recognize that property taxes are a type of rent to the government, and it is antithetical to the principles of private property rights – a right that is foundational to our republic.

Texans for Fiscal Responsibility has long championed the cause of completely eliminating property taxes in the Lone Star State through the Texas Prosperity Plan:

While reigning-in runaway local government spending, the plan calls for using 90% or more of the State’s surplus funds every two years to compress, or buy down, property tax rates, starting with school maintenance and operations (M&O) property taxes, until those rates are compressed to zero.

In addition to the property tax question, all of the remaining 12 propositions passed with overwhelming support.

These included several propositions with a more direct impact on taxpayers wallets, such as:

- Props 2 and 4 – securing the border and ending taxpayer-funded illegal immigration magnets

- Prop. 6 – defending our taxpayer-funded National Guard from unconstitutional wars

- Prop. 7 – expanding access to gold and silver as legal tender

- Prop. 11 – School choice and education freedom

- Prop. 13 – banning the sale of Texas land to hostile nations such as China

Taxpayers cannot rest, however, despite these propositions passing.

The establishment in Austin is notorious for attempting to ignore taxpayers and the grassroots, and rather cater public policy to help special interests and large corporations.

Taxpayers must get involved and continue to demand that lawmakers listen to them and pass the pro-taxpayer and pro-family reforms that Texas desperately needs.

You can learn more about these issues and how to get engaged at TexasTaxpayers.com.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!