If you have been paying attention to all of the noise surrounding property tax relief this session, you have probably heard the phrase, “We are going to give Texans the biggest property tax cut in history!” This was most recently said by Texas Gov. Greg Abbott in his State of the State address.

The number currently being promoted is $15 billion in tax relief. We have previously written about the deceptive nature of this number, since lawmakers are using $5.3 billion in old compression to puff up the actual amount of relief. New tax relief in the General Appropriations Act (GAA) totals $9.7 billion ($3B in homestead increase and $6.7B in new compression). Why, then, are they continuing to use that $15 billion number?

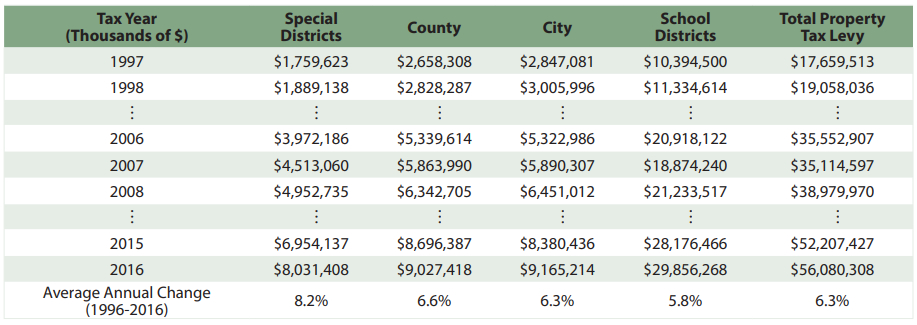

We found that in 2008, the largest amount in history was appropriated by lawmakers for property tax relief, totaling $14 billion. Sadly, this only resulted in about $400 less in tax levies the following year, and the tax burdens increased by nearly $5 billion in the next two years, as seen in the chart from the Texas Public Policy Foundation (TPFF) below.

This explains why lawmakers are using $15 billion—they are attempting to beat that historical $14.2 billion in relief. There are two problems with this:

1) $15 billion is not the amount of current property tax relief being offered; it is $9.7 billion.

2) This historic number has not been adjusted for inflation between then and now.

As many of us know all too well, inflation has been a major problem since the Federal Reserve began printing trillions of dollars under both the Trump and Biden administrations. When we adjust the $14.2 billion for inflation, we get just under $20 billion as the modern-day equivalent. It would be unfair to taxpayers to not account for inflation, since all Texas homes and salaries have felt the sting of inflation for years.

The reality is that our dollar is worth far less today than it was in 2008, and the Legislature should acknowledge that since they constantly adjust for inflation in their own budgets and staff salaries. (The House increased office allocations by 26% and the Senate by 45%, far above the levels of inflation.)

From the perspective of Texans for Fiscal Responsibility (TFR), the biggest historic property tax cut in history would be $20 billion. If we go with the real number being offered right now ($9.7B), we still have more than $10 billion to go. This would require the Legislature to break the constitutional spending cap since we only have about $4 billion before the cap is reached in the current proposed budget.

We believe this is how Abbott and other lawmakers can honestly give Texans the largest property tax cut in history, by breaking the spending cap and adding $10.3 billion in property tax relief. Taxpayers deserve more than the status quo, slowing the rate of growth without any significant relief.

Ultimately, lawmakers will have to choose between growing the government even larger or giving taxpayers the relief they have been promised for more than a decade.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note! Our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!