Oftentimes when operating in the world of fiscal policy, economists use certain terms and phrases and simply gloss over them, not realizing that everyday taxpayers may not understand.

A number of these come up from time to time, and I have found myself using the phrase “Keynesian economics” when speaking and engaging with our audience—and often meeting blank stares. It is not necessarily that this is a difficult subject to understand, but it is more due to the fact that our education system does a poor job of teaching economic theory. Today, we are going to explain what Keynesian economics is and the problems associated with it as an economic philosophy.

What is Keynesian Economics?

In simple terms, Keynesian economics is the school of economic thought that government intervention can stabilize the economy. Keynesian economics argues that the driving force of an economy is aggregate demand—the total spending for goods and services by the private sector and government. In the Keynesian economic model, total spending determines all economic outcomes, from production to employment rate. In Keynesian economics, demand is crucial—and often erratic. The concept is named after the economist John Maynard Keynes, who explained that the prosperity of whole economies could decline, even if their capacity to produce was undiminished, because the decline is influenced by demand.

Keynes came up with the theory in response to trying to understand the Great Depression of the 1930s. This economic system was used by U.S. President Franklin Roosevelt in his “New Deal,” in an effort to pull the U.S. out of the Great Depression. New Deal thinking has continued to plague the U.S. and current policy, as it continues to disrupt the free market to this day. The main idea implemented by Keynesians is that the government can be used as a tool by implementing activist fiscal and monetary policy to manage economic instability and fight unemployment.

Understanding Keynesian Policy

Previously, what Keynes dubbed “classical economic thinking” held that cyclical swings in employment and economic output create profit opportunities that individuals and entrepreneurs would have the incentive to pursue, and in so doing, they correct the imbalances in the economy. His definition of what he termed “classical economics” taught that in an economic downturn, lower demand would result in a lowering of prices and jobs. This would cause employers to make capital investments and ultimately hire more employees, resulting in economic growth. He did not believe that this system was capable of overcoming the Great Depression.

He believed that during recessions, business pessimism would actually make the economy weaker and cause demand to fall further. Keynes’s solution for recessions was that governments should undertake deficit spending to boost consumer spending and, as a result, stabilize demand. Essentially, Keynes encourages governments to go into debt to stabilize economies by “stimulating economic growth.” This is done in a number of ways, most recently by buying assets and/or giving stimulus directly to citizens.

The easiest way to understand this system is to know that Keynes did not believe markets should be free; he believed the market was unable to find equilibrium on its own and needed to be helped. This directly opposed the laissez-faire capitalism of Adam Smith.

Modern-day Ramifications

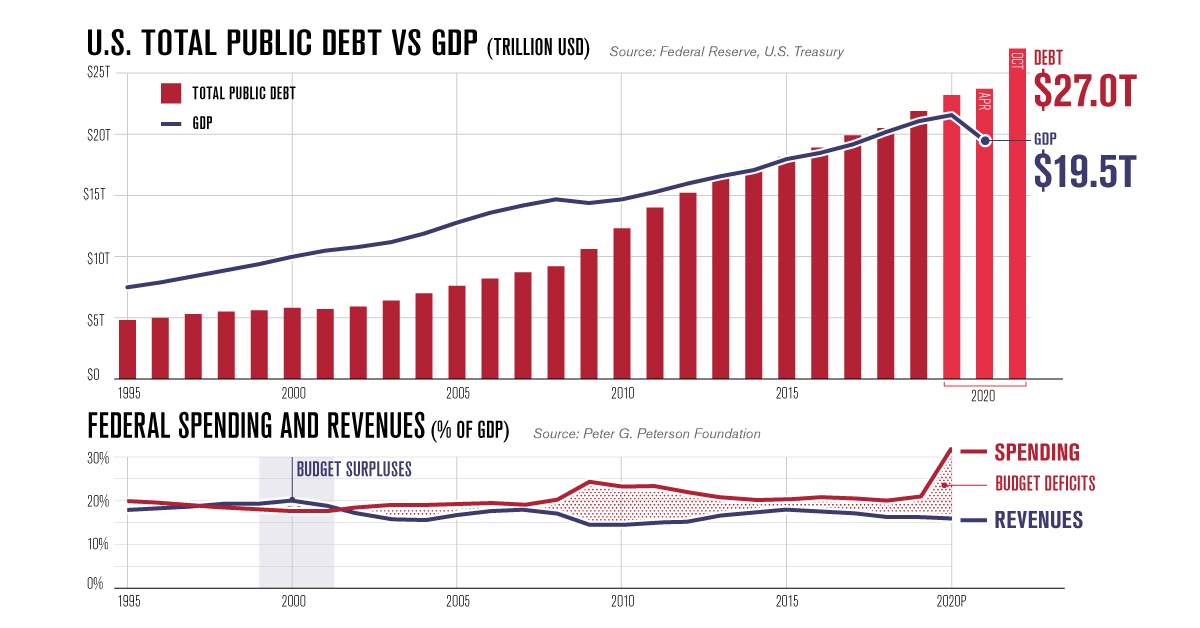

When we look at the last 20 years, we begin to realize the massive role Keynesian economics has played in our economy. The last few economic downturns (the “dot-com bubble,” the 2008 crash, and the COVID crash) were all met with Keynesian economic answers. Basically, our government and central bank (the Federal Reserve) turned on the money printer and let her rip. They bought assets, sent out stimulus checks, and essentially ignored our deficit. This is why the U.S. now finds itself more than $31 trillion in debt.

Sadly, the economic system that supposedly saved us from the Great Depression has resulted in a horrific economic fallout. What is happening now in our economy is like trying to dig ourselves out of a huge hole that we dug in the first place. We have an insurmountable budget deficit—yet with every economic downturn, our government and central bank jump at the chance to pile trillions more on top. This is simply not sustainable; eventually, this will all collapse in epic fashion. The only real solution would be to return to sound fiscal policy, begin paying down on the deficit, and bring our balance sheet out of the red. Unfortunately, the pain this would cause is not palatable for politicians, so we have continued our slide into debt.

An alternative to Keynesian economics would be the Austrian school, which we will cover in a future explainer.

So, what else can you do to get involved?

The next legislative session is set to begin in January 2023. Your elected officials need to hear from you.

Go read the Texas Prosperity Plan for yourself and voice your support for REAL property tax relief by signing up to support the TPP. You can also sign up for The Fiscal Note to stay updated on all fiscal issues that affect Texans, especially our broken property tax system. We CAN get real tax relief if we amplify our voices loudly enough.