Saturday, Texas voters took to the polls to consider two statewide constitutional propositions, local elected offices, and various bond proposals.

As the results came in, there appeared to be some very promising news for conservatives, especially in school board elections where more conservative candidates swept candidates advocating for things like CRT and child grooming in the classrooms.

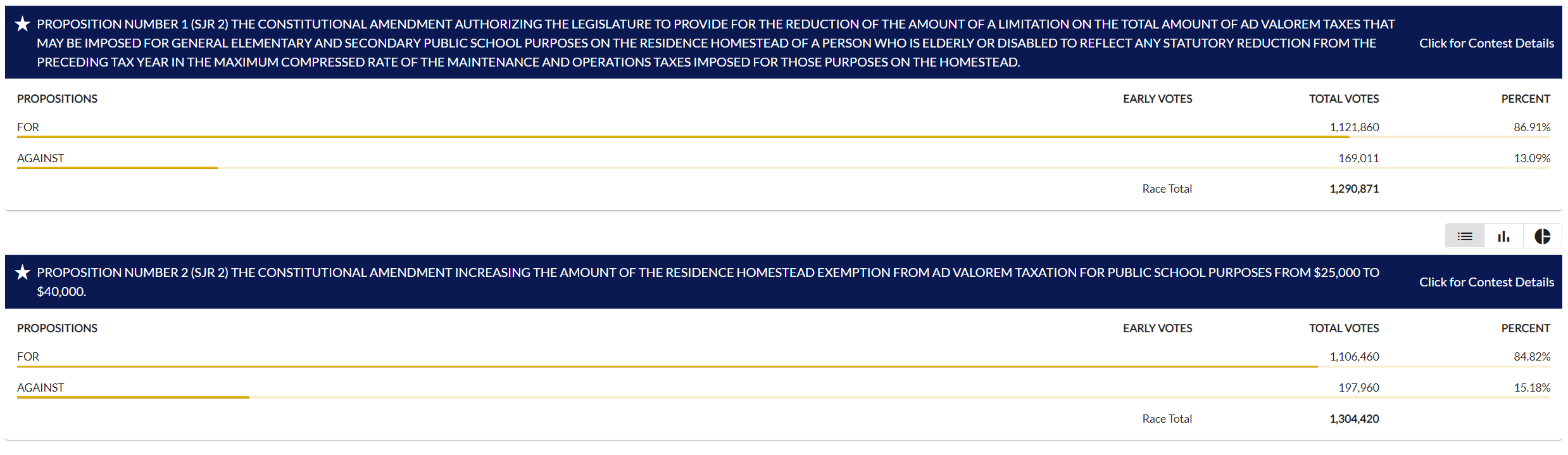

As expected the statewide propositions related to property taxes also passed with overwhelming support.

As seen in the results above, both propositions passed with about 85% support. Proposition 1 was a carveout for the elderly and disabled and Proposition 2 was an increase in the homestead exemption from that of $25,000 to that of $40,000. The likely reason that these two proposed constitutional amendments passed so easily is that Texas taxpayers are being crushed under increased property tax burdens. Sadly, these propositions represent yet another example of the Texas Legislature’s typical approach to property tax relief in the last decade, giving us gimmicks and no real relief at all.

The first proposition, the carveout for the elderly and disabled, is one of many types of “relief” legislation the legislature has passed in the last few legislative cycles. Why do they continue to pass the same type of “do nothing” legislation repeatedly? Because lawmakers want to keep the bulk of their voter base happy and it is no secret that the elderly currently make up the majority of voters in Texas. This is simply an effort by swindling politicians to keep the majority of their voters placated at the expense of the rest of us. The problem is that these types of carveouts do not actually provide relief, they simply slow the growth or freeze taxes at a certain level, ultimately raising taxes on those that do not qualify for the exemption. In no way can this be considered true property tax relief.

The second proposition increases the homestead exemption. To some, this might seem like a reasonable reform. If you watched the Senate Finance Committee hearing last week, however, you might feel differently. In this hearing, it was suggested that we stop tying homestead exemptions to static dollar amounts and instead use a percentage. This is because in high inflation environments, like the one we find ourselves in today, it necessitates constant adjustments to the amount of exemption. If it was based on a percentage we would have no need for lawmakers to come to rescue us every 5 years. This is why the homestead exemption is increased periodically, to keep up with inflation, making this time no different, with nearly double-digit inflation the $25k exemption has simply lost its original value as home prices skyrocket due to a myriad of bad policy decisions at the federal level.

Sadly no one will experience any significant property tax relief because of these two passed amendments. The best anyone could hope for is for your property taxes to stay the same, and that will not be the case for most people. Texans for Fiscal Responsibility (TFR) has been warning of this outcome for nearly a year, ever since the legislature decided to gut 2 property tax relief bills that would have actually provided significant relief for Texans and instead replaced them with shiny trinkets designed to appease low-information voters.

TFR has advocated for the use of surplus dollars to pay down M&O compression rates since the last Summer. However, since that time our surplus has only continued to grow! The estimated $8 billion surplus is now estimated to be nearly $15 billion when the State Comptroller releases his update BRE (Biennial Revenue Statement) sometime this summer. That amount, in combination with our bloated ESF fund ($13 billion) would equate to roughly $28 billion that is available for something like property tax relief. To give you an idea of how significant this amount is, it takes roughly $32 billion to run school M&O (Maintenance & Operations) state-wide in a year. With this amount, we could almost pay down an entire year of M&O property taxes in Texas (even if we decided not to make any budget cuts at all). In a biennium, this would result in a nearly 50% reduction in M&O property taxes if we dedicated the entire amount of surplus dollars and the ESF.

In the past year, TFR has advocated giving the surplus back to whom it belongs, you the taxpayer, in the form of actual property tax relief. The tax relief could be even more significant if we decided to cut our bloated budget, which has nearly tripled in the last 20 years, or if we banned the practice of taxpayer-funded lobbying which steals tens of millions from taxpayers every year to pay lobbyists who work against your interests.

Rest assured that we not only have the money to provide significant property tax relief, but we also have the ability to eliminate the M&O portion of the property tax completely. All that is needed is courageous lawmakers that are willing to be consistent with their “conservative” label. Real conservatives actively shrink the size of government and cut taxes significantly, neither have which have occurred in Texas in decades. We have never had a revenue problem in Texas, we have always had a spending problem.

As always, TFR will continue the fight against big government and support fiscal sanity here in the Lone Star State. We are here as a resource for anyone that needs us, please reach out if you have questions we can help with. Remember there are Primary Runoff Elections coming at the end of May which will be reporting on shortly. This is one of the best ways to have your voice heard on things like property taxes. Work to vote out fiscally irresponsible incumbents and vote for candidates that will commit to eliminating things like property taxes completely.