Monday, the Senate Committee on Finance met to discuss their interim charge related to property tax relief. They had the usual suspects show up as invited testimony: The Comptroller’s office and the Legislative Budget Board among others to discuss the possibility of getting property tax relief to millions of Texans drowning in growing tax burdens across the state. The last time they convened, it seemed based on comments and questions from committee members, that they had no intention of bringing any meaningful relief to Texans, aside from paying down a few pennies on compression rates. This last meeting made that even more apparent.

The most glaring example of this in the committee meeting was the committee’s interaction with Vance Ginn, Ph.D., Chief Economist for the Texas Public Policy Foundation, who has been promoting a plan to eliminate property taxes in Texas. Similarly, Texas for Fiscal Responsibility (TFR) has been promoting the same idea for over a year, with a slightly more aggressive approach in that we believe that we do not need to create any new taxes to accomplish elimination. Nevertheless, the TPPF Lower Taxes, Better Texas plan is well thought out and is a completely feasible plan to eliminate property taxes in Texas. The plan suggests raising sales taxes in order to bridge the gap, which actually follows the Republican Party of Texas’ platform plank that suggests using a consumption-based tax to offset property taxes.

Dr. Ginn started out by naming inflation as a big concern for families in Texas and that increasing property tax burdens were yet another obstacle for families to stay afloat. He acknowledged one of the major drivers of this was the school Maintenance and Operations (M&O) tax and began to address the idea of using surplus dollars to ‘buy-down’ or begin eliminating them (something TFR has been advocating for as well). He asked the question that again reinforced TFR’s position, “How can we actually lower property tax bills, not just slow the growth rate?” Slowing growth has been the Texas legislature’s status quo for a decade and despite their proclamations of “historic property tax relief”, no one’s bills have gone down despite these policy changes. He added, “Whenever you ask many Texans… it’s not that the property tax bill is going up too fast, it’s that the property tax bill is too high already.”

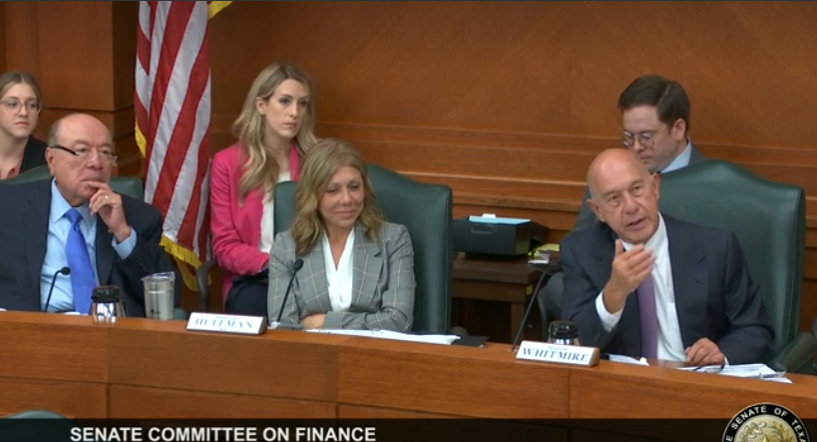

But before Dr. Ginn could even finish his opening statement he was interrupted by State Sen. John Whitmire (D-Houston) (who scored an abysmal 14 on the most recent Fiscal Responsibility Index). Whitmire asked if he [Dr. Ginn] “would ever be happy with a level of taxation considering the services taxes provide?” Dr. Ginn responded by saying that staying within the conservative metric of population plus inflation is a good guide. Whitmire did not seem to acknowledge that response, continuing to opine that the collection of property taxes provides for emergency services and the need for more and more tax dollars. Whitemire ultimately concluded that if they keep chipping away at the property tax revenue they might be forced to make budgetary cuts (God forbid!).

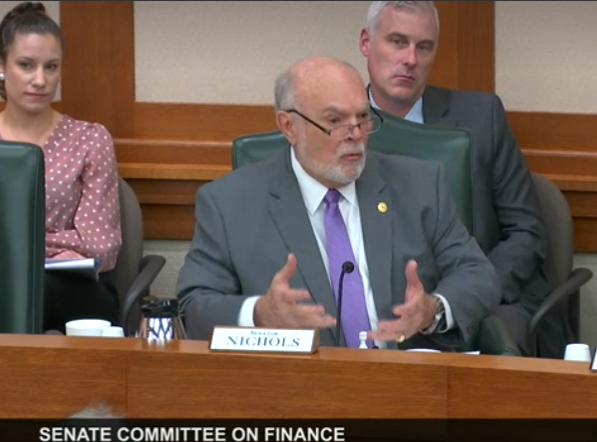

Immediately afterward, State Sen. Robert Nichols (R-Jacksonville) (who scored a 71 on the most recent Fiscal Responsibility Index) chimed in, expressing worry that counties would do not have sales taxes would not benefit from the TPPF’s plan because they don’t have a way to offset a loss in property taxes, to which Dr. Ginn conceded. This point is why TFR has advocated to not replace the property tax with anything because all that is actually needed is to make big enough budgetary cuts to prioritize property tax relief, leaving no need for the use or replacement in revenue by sales taxes. Nichols seemed to insinuate that the state legislature would be too confused on how to supplement the funding in these counties and asked Dr. Ginn how he would fund them? Dr. Ginn answered with an amazing response, “We do want to make sure that taxpayers are part of the process as well.” Dr. Ginn continued to explain the TPPF plan to “eliminate the school M&O tax by buying down compression rates over time using surplus dollars.” Nichols responded by saying TPPF has some real weak spots in their plan.

Finally, after that exchange, the Senate Finance Committee Chairman, State Sen. Joan Huffman (R-Houston) (who scored a 69 in the most recent Fiscal Responsibility Index) attempted to pile on as well, explaining to Dr. Ginn (who has a Ph.D. in Economics) what surpluses are and how they work. Dr. Ginn responded to the comment by giving the correct definition of surplus dollars, “Surplus dollars are no more than excessive dollars taken from the taxpayer by the state, those dollars should be returned to the taxpayer”. Ultimately, Dr. Ginn said that the most needful form to return tax dollars is through property tax relief. Huffman responded by saying, “there is not going to be a surplus every time, it’s rare.” Dr. Ginn then went on to explain that fiscally responsible policies that limit government would continue to produce surpluses.

These exchanges serve as yet another great example of what many state lawmakers are already thinking when it comes to how to use the projected massive surplus they will have when they return for the 88th legislative session in January and surpluses going into the future. Seemingly, many have no intention of giving it back to taxpayers in any meaningful way, because if you spend that surplus on other budgetary items, there is in fact no surplus. This could be best analogized to that of you getting a bonus from work and instead of paying off debts, you go and buy a motorcycle. When your spouse asks why you did not pay off debt, you tell her you could not because you had to buy a motorcycle. This is the game lawmakers are playing with billions of your hard-earned tax dollars.

Taxpayers should know, based on the direction of the interim committee hearings that it does not appear that the legislature is willing to choose taxpayers over special interests in Austin. As TFR has said in the past when there is a big pile of money available to spend, rest assured lobbyists and special interests will be working hard to convince lawmakers the swamp needs it more than you. After all, they keep getting reelected, despite ignoring the cries of Texas taxpayers continuously on this issue.

TFR hopes this will change and we aim to continue to educate taxpayers on how best to engage with lawmakers in an effective manner to promote fiscally responsible policy in Texas. As a matter of fact, next week we will be premiering our own plan to accomplish this. Please be on the lookout for new articles and videos explaining how we can convince corrupt lawmakers to make good on their campaign promises to taxpayers!

Please tell your friends that are worried about increasing tax burdens to sign up for our weekly email called the Fiscal Note to stay up today on Texas news and to hear about our new Texas Prosperity Plan!