Corporate Welfare

Fighting Woke Corporatism

It’s difficult to be a conservative in today’s society and not notice the clear bias held by many large corporations that have injected themselves into the political realm. These entities almost always lean left and have aided in silencing and…

Texas House Interim Charges Released – Missing Major Priorities

Last week, Texas House Speaker Dade Phelan (R-Beaumont), released his list of interim charges to all House committees. Every legislative cycle, the leaders of each respective legislative chamber issue interim charges for each committee to study in preparation for the…

Spotlight on the 87th: Subsidies for Wind and Solar

In today’s Spotlight on the 87th Legislative Session, we look back on legislation that protected subsidies for unreliable wind and solar energy. House Bill 1607 was authored by State Rep. Drew Darby (R-San Angelo) and was passed out of the…

Spotlight on the 87th: Music Venue Subsidies

In today’s Spotlight on the 87th Legislative Session, we look back at Senate Bill 609, authored by State Sen. Carol Alvarado (D-Houston). SB 609 created a new corporate welfare program for music venues by creating the Texas Music Incubator program…

Potential Resurrection of Additional Corporate Welfare in the Works

On Wednesday, Texas House Speaker Dade Phelan (R) took to Twitter to talk about a speech he gave at the annual Ad Valorem Tax Conference hosted by the Texas Oil and Gas Association in San Antonio. Among the issues he…

Explainer: What Is The Texas Enterprise Fund?

One of many government programs that many Texans have no clue exists is the Texas Enterprise Fund. Millions of tax dollars are distributed from this program, yet it never receives much attention from the public. The program is administered via…

TFR Statement on State Budget

Following the Texas Senate’s passage of the conference committee report on the state budget, Texans for Fiscal Responsibility president Cary Cheshire issued the following statement: Texas lawmakers have passed a budget that does not deliver substantial property tax relief. Instead…

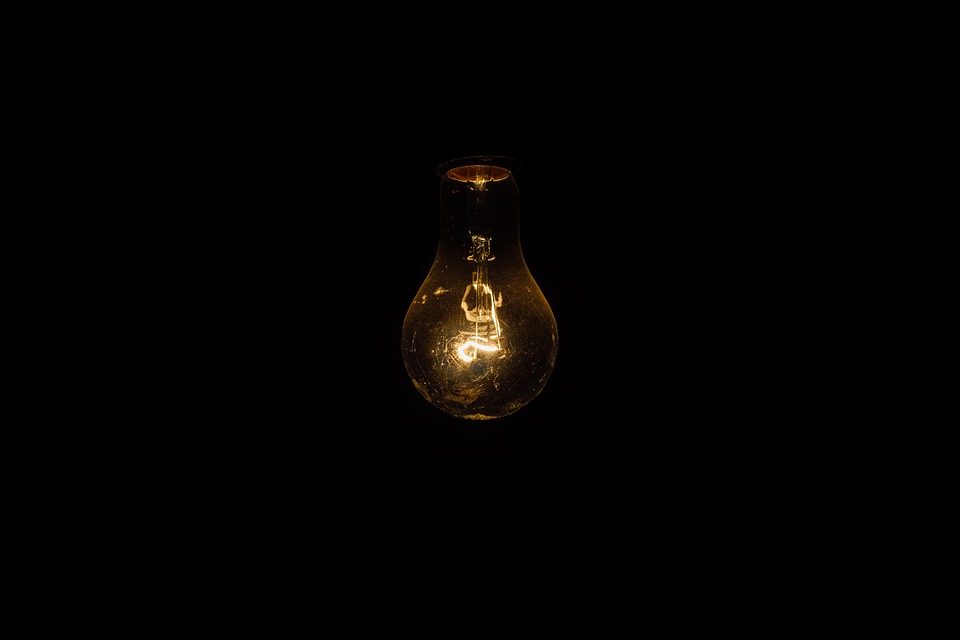

Explainer: The Texas Blackout: What Happened? How do we fix it?

Following the disastrous Texas blackout in February 2021, TFR created the following video explaining part of the problem and potential solutions to safeguarding the life, liberty, and property of everyday Texans. While further reforms are most assuredly needed, action…

Eliminate 312 Tax Abatements, Lower Tax Rates Instead

Originally implemented in 2001, property tax abatements have exploded as local governments across Texas compete with each other in an endless cycle of targeted giveaways to big business. The time to end this unfair, costly, and crony practice has come. Defined…

Texans to Pay Out Tax Abatements for 41 More Wind and Solar Plants in 2021

As extreme cold batters the Lone Star State and power failures leave millions huddling for warmth in their homes, dealing with broken pipes, and rendering many roads unnavigable, many Texans are looking to the latest from ERCOT or the weather…

Taxpayers Subsidizing Mavericks Decision to Forego National Anthem

Mark Cuban and the Dallas Mavericks’ decided to axe the pre-game playing of the national anthem for the foreseeable future—a development that sparked widespread condemnation from Texans. .@mcuban Your decision to cancel our National Anthem at @dallasmavs games is a…

Three Things Taxpayers Should Know About the Proposed Samsung Deal

In late January, news broke that Samsung is seeking a 100 percent tax rebate from the City of Austin for more than 20 years in exchange for building a $17 billion facility within its borders. As more continues to unfold…

Samsung Seeking Big-Time Tax Incentives from City of Austin

A big technology company is seeking big-time tax incentives in order to make a big investment in the Texas’s capital city. On Thursday, Community Impact’s Christopher Neely reported Samsung Semiconductor is seeking a 100 percent tax rebate from the City…

Eliminate the Texas Enterprise Fund, Cut Taxes Instead

Compared to most states, Texas is among the most business friendly with no tax on personal income, fewer regulatory barriers relative to many of its neighbors, and an engaged and enterprising workforce. However, the state could be even more business…