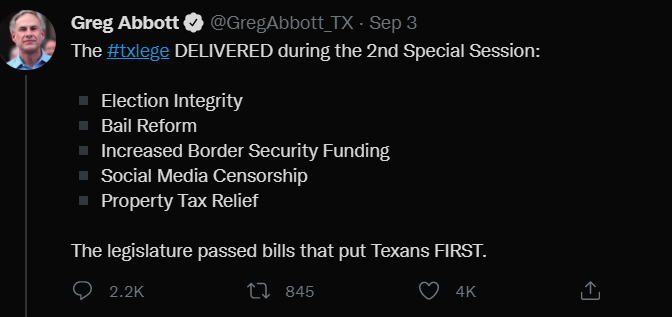

Recently Governor Abbott tweeted that among other conservative legislation, the Texas legislature just passed property tax relief.

This should be cause for celebration! We finally got what we have spent years begging our elected officials for! We are finally going to see significant property tax relief! Right?

Wrong.

If you were at a restaurant and you ordered a steak, but the server brought you spaghetti instead… would you be upset? Would you say something to them or just be happy that they brought you anything at all?

TFR has been focusing on true property tax relief through elimination for months now. We have championed HB 122 by Rep. Tom Oliverson (R-Cypress) throughout the last month. HB 122 was the only bill that came close to providing what Texans asked for. It would have used 90% of ongoing budget surpluses to pay down the school property tax rate until it was eliminated. However, the Texas legislature had other ideas…

We believe Texans ordered a steak, but what did the legislature actually bring us?

Here are the two bills we were served after ordering a path to school property tax elimination:

- This allows a homeowner to receive their homestead exemption in the year that they acquire the property, rather than having to wait for January 1 of the following year

- Homeowners would benefit from a prorated exemption based on when the home was acquired (from a few months to almost a full year)

- General homestead exemptions are $25,000 which lowers the value in which school districts tax your home. So a $100k home could only be taxed $75k.

- The average home price in Texas for 2020 was around $250,000 and the average school tax rate was about 1.21%. This means based on a middle-of-the-year purchase (prorated 6 months) the average texas homeowner would receive $151.25 in tax breaks with this exemption. (If 11 months were used it would be $275.)

- A maximum one-time benefit of $275 dollars.

- School districts are protected from revenue loss, being reimbursed from the state for any lost revenue.

- This bill seeks to match the compression rates for individuals that are over 65 or are disabled.

- This would match the compression rates for the rest of the population.

- It is narrowly focused on a specific group of people and does not affect all taxpayers (carve-out).

- School districts are protected from revenue loss, being reimbursed from the state for any lost revenue.

Both SB 12 and SB 8 were filed by Senator Paul Bettencourt (R-Houston) and have been sent to the governor’s desk.

The problem with both of these pieces of legislation is that they provide minimal tax relief and more significantly, they are not what taxpayers asked for. For years Texans have asked for the elimination of the property tax. Yet Texans have received spaghetti last few sessions. This special session marked the first time that a bill with the goal of eliminating the school property tax had serious traction.

Yet instead of giving taxpayers that glorious ribeye we asked for, we got a steaming pile of spaghetti, and we are told we should like it. With rogue appraisal districts inflating home values it is unlikely most homeowners will see any significant reduction in their property tax bills next year based on the “property tax relief” that was given to us.

Taxpayers are going to have to decide if they are going to sit quietly and be thankful for the spaghetti the legislature gave us, or if we are going to demand the steak that we ordered… a real path to property tax elimination.