In an interview with The Texan, Texas Comptroller Glenn Hegar indicated that it is possible Texas will have an estimated $30 billion account balance when the Texas Legislature reconvenes in January of 2023. In March, we reported that it was estimated to be near $25 billion.

In response to the interview, Texas Gov. Greg Abbott took to Twitter, but instead of calling for the elimination of property taxes as he had done back in May, he indicated that Texas must use an unspecified amount of the budget surplus to cut them.

Texas Comptroller Estimates $30 Billion Account Balance by Next Legislative Session.

We must use a substantial portion of this money to cut property taxes in Texas. https://t.co/WItfGeZsQi

— Greg Abbott (@GregAbbott_TX) June 21, 2022

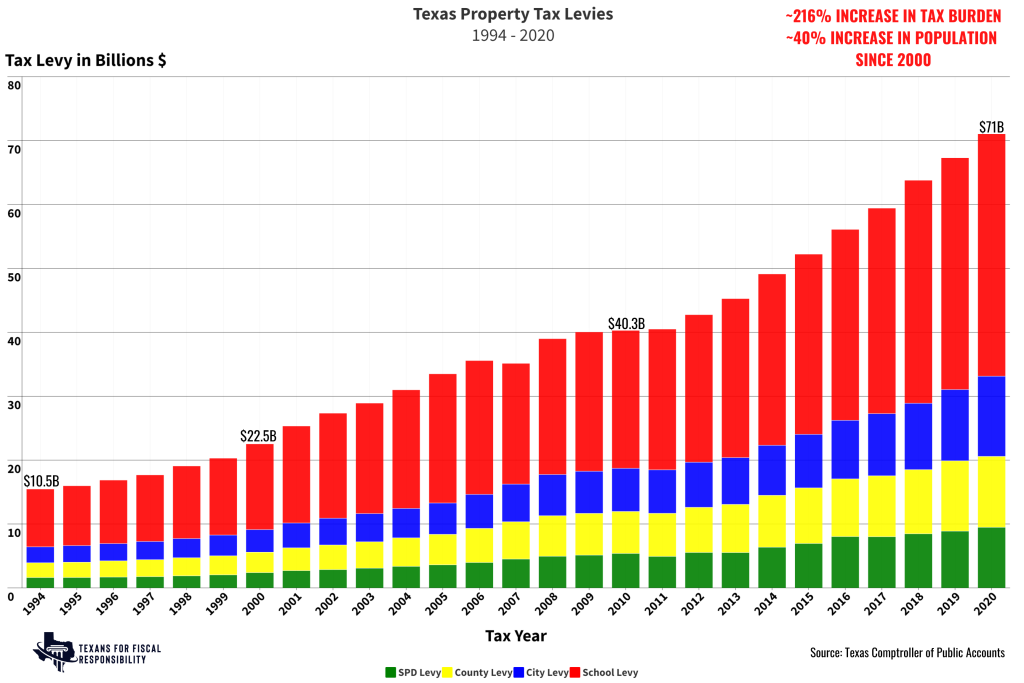

The problem? It is not enough to ‘cut’ them. The Texas legislature has previously tried the ‘slow-the-growth’ strategy, and yet the burden on Texas taxpayers continues to grow.

Abbott’s own political party just held its state convention last week where delegates were poised to adopt a legislative priority explicitly calling for the elimination of property taxes. The final results of the convention will not be available until this next week. Moreover, Republican primary election voters overwhelmingly supported eliminating the property tax back in March.

Using Surplus(es) to Put Texas on a Path to Property Tax Elimination

As a part of the Texas Prosperity Plan, Texans for Fiscal Responsibility (TFR) has called for the use of all of the budget surplus to be returned to the taxpayer in the form of actual tax relief, by initially using it to ‘buy down’ the maintenance and operations portion of the property tax (the largest portion, ~65%) and thereby putting Texas on a real path to the elimination of such taxes.

It is not enough to call for a property tax cut. Texas taxpayers need and demand true relief from an immoral tax, which has seen its burden only grow, despite paltry trinkets of purported relief from state lawmakers. Using the surplus monies to initially eliminate the largest portion of the total property tax will help deliver true relief, and enable additional efforts for full elimination.

(Chart)

(Chart)

In May of this year, Abbott voiced support for the elimination of the school district M&O tax rate, but as interim hearings unfolded in both the Texas House of Representatives and Texas Senate, it appears some lawmakers might have varying opinions on how best to use surplus dollars, focused on continued ‘relief’ and other priorities as opposed to working toward its elimination.

The Senate’s interim charges, ultimately distributed by Lt. Gov. Dan Patrick (R), do in fact call for the use or dedication of “state revenues in excess of the state spending limit to eliminate school district maintenance and operations property tax.” By comparison, the House of Representatives’ interim charges, distributed by House Speaker Dade Phelan (R), merely focus on appraisal reform and using previously earmarked funds from the American Rescue Plan Act (ARPA) passed by the U.S. Congress in 2021.

The Estimated $30 Billion Surplus

Where does the $30 billion figure come from?

Hegar estimates that the state treasury should have a balance of somewhere between $15 billion to $16 billion by the end of 2022, whereas the ‘Rainy Day Fund’ or the Economic Stabilization Fund (ESF) is projected to have between a $13 billion and $14 billion balance by January of 2023.

According to the Comptroller’s website, total tax collections are up 35% from this same time last year. Notably, state Sales Tax collections are up over 21%, and Oil and Gas Taxes are up 195% from last year and 90% overall. It is important to take all of these numbers into context given the record inflation and higher costs of goods and services as a result.

There is a Better Way

TFR recently debuted its Texas Prosperity Plan, which focuses on banning the practice of taxpayer-funded lobbying, eliminating property taxes, and freezing our state budget growth.

We believe this plan would continue to put Texas’ fiscal future on a great footing and ensure prosperity for current and future generations of Texans.

How can you help? Go read the Texas Prosperity Plan for yourself and voice your support for REAL property tax relief by signing up to support the TPP. Sign up for The Fiscal Note to keep up to date on all fiscal issues that affect Texans, especially our broken property tax system. We CAN get real tax relief if we amplify our voices loud enough.