For all of Texas’ economic successes, the ever-increasing property tax burden on Texas taxpayers casts a long and dark shadow.

In 2021, the Tax Foundation reported that Texas had the sixth most burdensome property tax in the United States. Just one year earlier, WalletHub reported that Texas had ranked seventh.

For years now, the approach by state lawmakers to this reality has been to slow the growth of property taxes by appropriating a specific amount of money (i.e. collected tax dollars) to property tax relief, as opposed to creating an environment where that burden actually decreases from the year prior. Now, it is true that it is the local governments that set the rates, but lawmakers aid in creating the environment by which those local governments can do so.

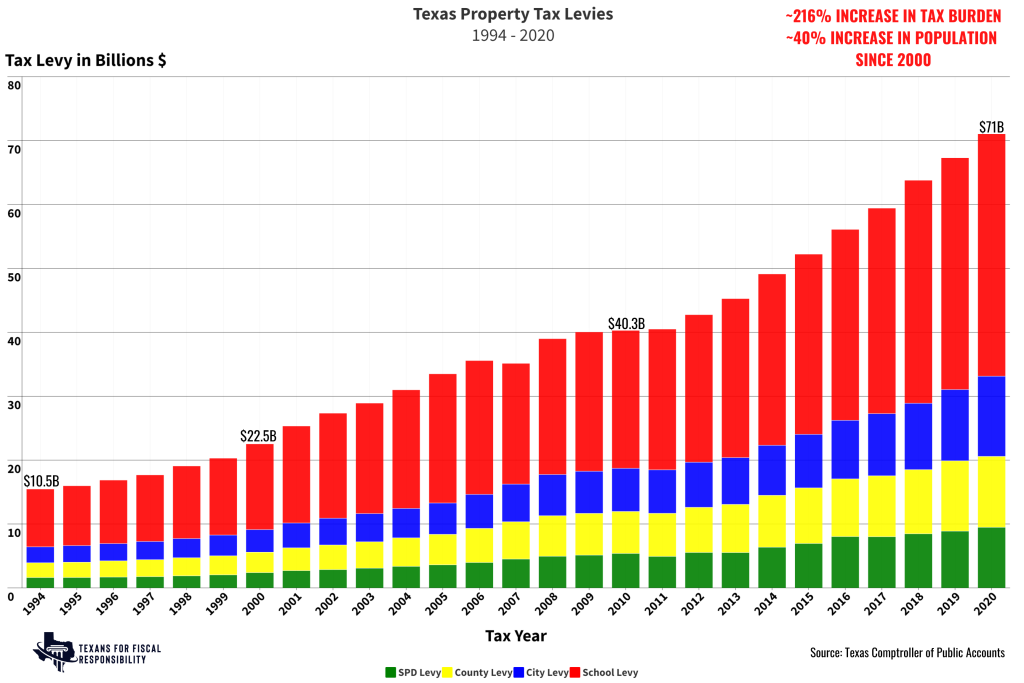

As seen in the chart below, the overall property tax burden has increased over the last few decades. With collections totaling $71 billion in 2020 alone, up from $22.5 billion just 20 years earlier and $40.38 billion a decade ago, the overall burden on Texas taxpayers shows no signs of slowing down.

State lawmakers have consistently paid lip service to this phenomenon. In 2019, the state legislature passed the Property Tax Reform & Transparency Act; though it provided some good reforms overall, it has done nothing to provide tangible relief.

In fact, lawmakers have taken to the practice of gaslighting taxpayers to explain away the issue. For example, Republican State Sen. Paul Bettencourt (Houston), who also happens to be the author of the property tax reform legislation that passed in 2019 and chairman of the Senate Local Government Committee, consistently trumpets the 2019 reform as saving the taxpayer $6 billion. The reality is that it slowed the growth, but the taxpayer still pays more.

At @TTARA talking MEANINGFUL Property Tax relief. SB2 and HB3 are the most significant Property Tax reform in DECADES. It's saving YOU, the taxpayer, 6 BILLION DOLLARS! #TTARA2022 #txlege pic.twitter.com/oJeblhlLrR

— Team Bettencourt (@TeamBettencourt) October 21, 2022

And herein lies the semantics problem.

What Defines a Cut?

If you are a lawmaker, using the term “cut” seems to be synonymous with just slowing the perpetual growth. If you are a taxpayer, you would assume a “cut” would actually mean paying less than you previously did. In all of our travels across the state of Texas and in all of our conversations with Texas taxpayers, we have yet to find anyone whose property taxes have actually gone down.

The problem with the approach lawmakers have chosen to take? Government still grows and taxpayers still pay more in property tax.

The reality is, no major city in Texas adopted the no-new-revenue rate, even though lawmakers promised they would. Local governments all across the state are using a loophole to raise taxes without approval elections, a key reform included in the 2019 legislation. Though the growth of property taxes themselves might have been stifled, the burden continues to increase.

Majority Party Platform

It is worth mentioning that it is Republican elected officials who have controlled the majority in the state legislature and every statewide elected office for nearly two decades. Despite this and promises to address the issue previously, property tax burdens have only continued to increase for Texas taxpayers.

The 2022 platform for the Republican Party of Texas explicitly says this about property taxes:

90. Axe the Property Tax: We support replacing the property tax system for businesses and individuals with an alternative other than the income tax and requiring voter approval to increase the overall tax burden. We urge the Legislature to immediately develop and implement a transition plan that is a net tax cut.

Similarly, in the 2022 Republican primary election, Republican voters overwhelmingly supported a proposition that read as follows:

“Texas should eliminate all property taxes within ten (10) years without implementing a state income tax.”

The platform continues:

91. Property Tax Relief: We support these incremental steps toward the ultimate abolition of property tax:

a. Dedicate surpluses to buy down school district maintenance and operation property tax.

b. Replace the appraisal system with a system that values property at the purchase price.

c. Require appraisal districts to publish the amount of property taxes and appraisals attributable to each rental unit

d. Close the loophole called the “Unused Increment Rate,” which allows taxing entities to bypass recently added limits to increases in property taxes.

Will lawmakers, of which there is a Republican majority, abide by their own party’s platform and what an overwhelming majority of Republican voters supported in the 2022 Republican primary? Taxpayers we surveyed do not seem confident lawmakers will do so.

If there has ever been an opportunity to address the issue, it is now.

Republican Leadership Giving the Issue Attention

Texas Comptroller Glenn Hegar recently indicated that state lawmakers will be facing a nearly $27 billion surplus in the next legislative session. Government is not a for-profit enterprise, so a surplus actually means an over-collection of taxpayer money.

Also included in the aforementioned platform is a plank that speaks to how Republicans believe the surplus should be used:

76. State Fiscal Restraint: We urge the Legislature to amend the Texas Constitution and State statute with a stricter spending limitation based on US Census population growth plus inflation, as measured by the Consumer Price Index, and apply the new limit to Texas’s total government budget. We call on the Texas State Legislature to freeze state spending until wasteful programs have been eliminated, a sustainable size of government has been restored, and substantive property tax relief has been provided to Texas citizens. Any budget surplus shall be applied to property tax relief.

Shortly after the comptroller’s prognostication, Texas Governor Greg Abbott indicated his willingness to use a “large chunk of this money [surplus] to provide the biggest property tax cut in the history of Texas.” He later clarified that he intends to use at least half of the projected $27 billion surplus for such purposes when the legislature reconvenes.

Similarly, Texas Lieutenant Governor Dan Patrick initially said he was comfortable using only $4 billion of the projected surplus for tax relief purposes. He reportedly has increased that number to nearly $11 billion.

Curiously, the Republican Speaker of the Texas House of Representatives, Dade Phelan (Beaumont), has been silent on the issue. Earlier this year, he issued interim charges related to property taxes to the House Ways & Means Committee, but he has stopped short of calling for any specific use of the projected surplus.

In the sole gubernatorial debate leading up to the ongoing November general election, Abbott said he wants to eliminate school property taxes (the largest portion of the overall tax levy). This rhetoric is a positive sign leading up to the legislative session.

Texans for Fiscal Responsibility believes that the property tax is immoral and that Texans will never have the ability to own their property while simultaneously having to pay perpetual rent to the government. TFR believes that the tax should be eliminated and, as a part of the Texas Prosperity Plan, believes lawmakers should use all of the projected budget surplus to buy down the school portion of the property tax and put Texas on a path to the elimination of the tax altogether.

What is Next?

The next legislative session is set to begin in January of 2023. Your elected officials need to hear from you.

How can you help? Go read the Texas Prosperity Plan for yourself and voice your support for banning taxpayer-funded lobbying, eliminating the property tax, and freezing state spending by signing up to support the TPP. Sign up for The Fiscal Note to stay up to date on all fiscal issues that affect Texans, especially our broken property tax system. We CAN put Texas on a path to fiscal sanity and future prosperity if we amplify our voices loudly enough.